Many Maine contractors drive personal vehicles for business every day. Cleaning contractors drive their own cars to jobs from Cape Elizabeth to Cumberland. Food delivery workers pop a magnetic sign on the roof and zip through Portland streets. Uber drivers shuttle people to and from the Old Port in their SUVs. Landscapers haul mowers on trailers from Scarborough to Yarmouth. Carpenters and handymen load tool boxes and ladder racks for Munjoy Hill rehab projects. In winter, contractors from Kittery to Fort Kent pick up plow jobs to pay the bills.

Does a Personal Policy Cover Contractor’s Business Use of a Vehicle?

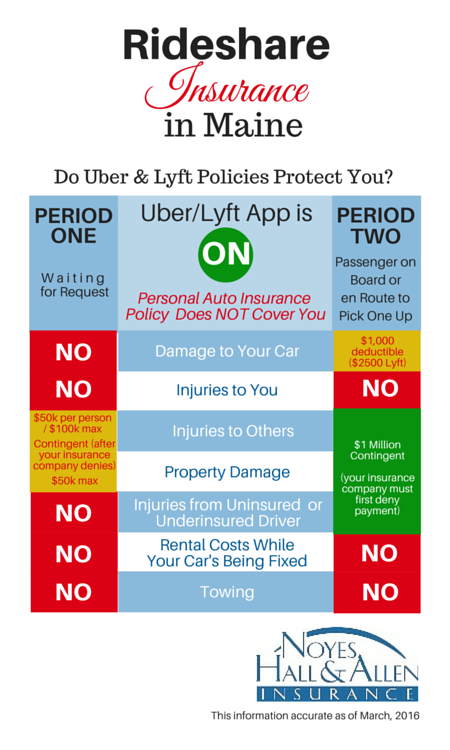

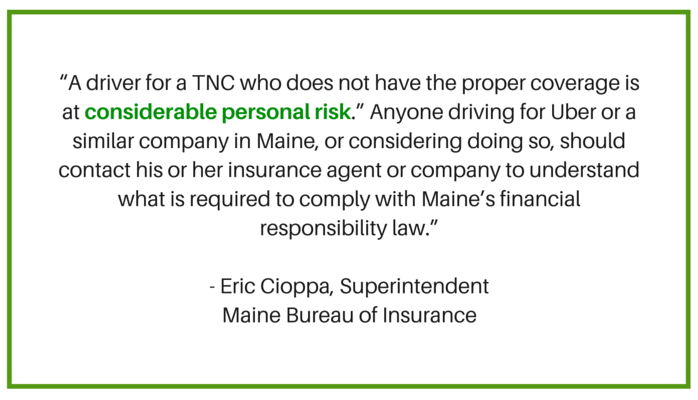

Maybe not. Many insurance companies exclude delivery or transporting commercial goods. If you’re in a crash hauling your tools or delivering a pizza, you could find yourself with no coverage. Almost every personal policy excludes carrying passengers for a fee (Uber or Lyft).

If My Truck Has Lettering on the Side, Does it Require Commercial Insurance?

Lettering can be a “tipping point” when defining a business vehicle. Is your truck lettered? Talk to your Maine contractor’s insurance agent to see if you need to switch to a business policy. Avoid a surprise at the absolute worst time – after an accident.

What if I’m in an Accident With My Contracting Truck on My Personal Insurance Policy?

You may have no coverage (see above). Even if your policy doesn’t exclude your claim, your personal insurer won’t be happy. After paying, they could cancel your family’s insurance. Or, they could force you to insure your truck on a business policy. At the very least, they would surcharge your policy for the claim.

What’s the Advantage of Business Auto Insurance?

Compared to a personal auto policy, a commercial vehicle policy allows you to:

- Get coverage for business use of the vehicle – which is the whole purpose of having insurance at all.

- Buy higher liability limits – to meet job requirements, and better protect your business assets and reputation.

- Have Loading and Unloading coverage – If you yank the wires from a customer’s house while pulling your ladder off your rack, that’s not covered by your business liability insurance. Business Auto policies cover it.

- Purchase higher rental limits, so you can rent a vehicle comparable to the one that’s damaged. No one wants to show up for a carpentry job in a subcompact car.

- Include non-owned auto coverage – protects your business if someone crashes while picking up a part or a tool for you with their own vehicle.

- Separate your personal life from your business. You don’t want to explain to your spouse why their insurance was canceled, or the price increased so much.

- Insure larger vehicles – most personal policies don’t insure anything bigger than a 3/4 ton pickup.

- Include attached equipment – like tool boxes, ladder racks or signage.

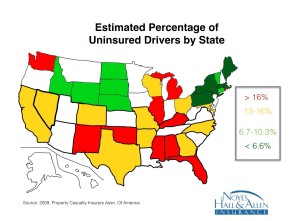

How Much Does Commercial Vehicle Insurance Cost in Maine?

It varies of course, depending on the vehicle and use. Plan to spend about $100 a month for a contractor’s pickup truck with collision coverage and $1 million of liability coverage. Prices can decrease if you have more vehicles, or increase if you have bigger trucks.

Would your Maine auto insurance pay if you were in an accident at work? Have questions about Maine contractors insurance? Contact Noyes Hall & Allen in South Portland at 207-799-5541, or click “let’s talk” below. We’ve helped contractors to stay on the job and out of hot water since 1933. Because we represent many insurance companies, we’re independent and committed to you.

You Might Also Like: