Note: This discussion applies only to Insurance Services Office (ISO) coverage forms. These are used by most insurance companies in Maine. Some insurers (Allstate, State Farm, Travelers and more) use their own proprietary forms. If you have a quote or a policy from those companies, ask an agent to explain the coverage you’re buying.

All Maine homeowners policies are not created equal. In fact, if your policy is properly written, there may not be another like it. HO-5 and HO-3 are common insurance policy forms with important differences, even though they look very similar.

HO3 vs. HO5

One key example is the difference between ISO HO-3 and HO-5 homeowners forms. The HO-3 was the most popular coverage form for decades. It covers a broad scope of building damages, but more limited coverage for your personal belongings.

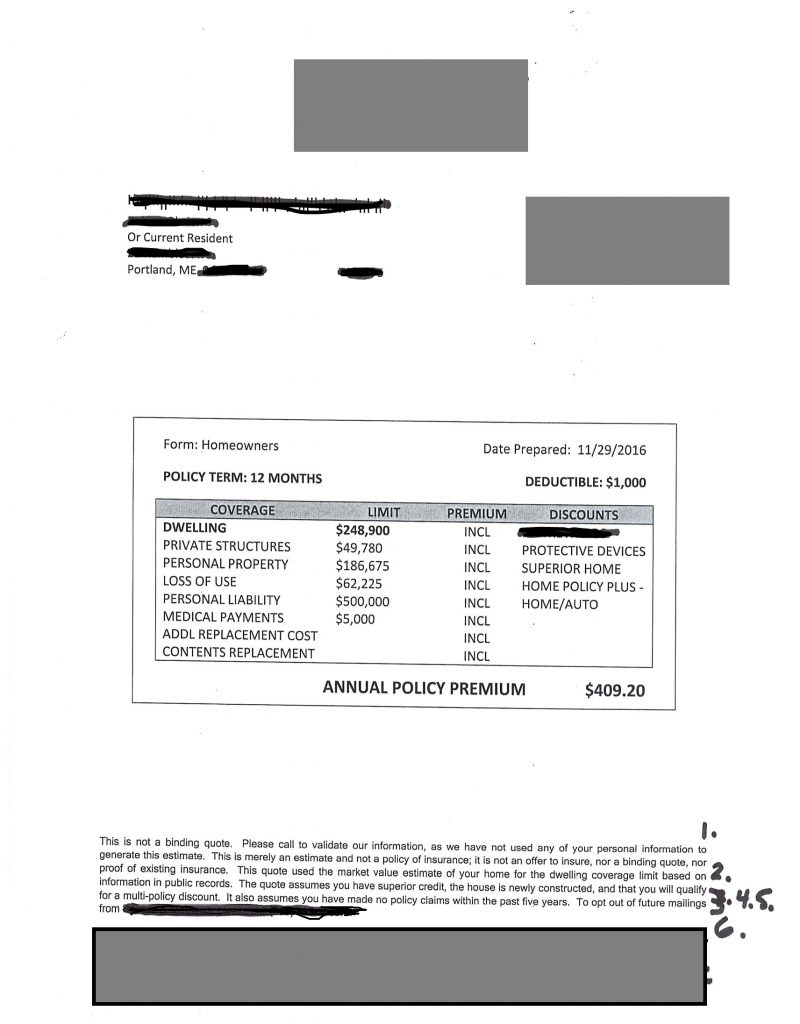

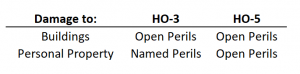

A quick chart:

Open Perils – Covers any cause of loss unless excluded.

Named Perils – Covers only damage from specified causes.

The HO-3 covers personal property against 16 named perils:

- Theft

- Fire or Lightning

- Freezing

- Windstorm or Hail

- Accidental Discharge or Overflow of Water from Plumbing

- Vehicles

- Smoke

- Weight of Ice, Snow, or Sleet

- Vandalism or Malicious Mischief

- Sudden & Accidental Tearing Apart, Cracking, Burning, or Bulging

- Sudden & Accidental Damage from Artificially Generated Electric Current

- Falling Objects

- Volcanic Eruption

- Riot or Civil Commotion

- Aircraft Damage

- Explosion

Why Buy HO-5 Instead of HO-3?

The open perils HO-5 form shifts the burden of proof from you to the insurance company. You’re not required to prove that the damage to your personal property was caused by one of the 16 named perils. It’s covered, unless it’s specifically excluded. Believe it or not, insurance adjusters prefer the HO-5 to the HO-3, too – even though it provides a lot more coverage. It makes proving coverage much more simple and easy.

What does an HO-5 Cover that an HO-3 Doesn’t?

Because the coverage is so broad, many additional types of damage are covered. Here are a few:

- On a hot August day, a freak thunderstorm hits while you’re at work. Rain blows through an open window, damaging your home entertainment system.

- At a dinner party, a guest spills a glass of red wine on your oriental carpet, damaging it.

- A skunk finds its way through your open patio door. You startle it, and it sprays inside your home. All of your upholstered furniture must be deodorized.

Admittedly, these are uncommon claims. But clients often call insurance agents to report damage that’s NOT covered. Wouldn’t it be good to put the odds in your favor?

How Much Does an HO-5 Cost?

The cost to upgrade from HO-3 to HO-5 varies by insurer. Believe it or not, an HO-5 with one insurer may cost LESS than an HO-3 with another. Some insurers only offer HO-5 coverage for preferred properties and clients. That means you may qualify for very good pricing to begin with, which could save you money from your current HO-3 policy. If you qualify for both forms, the HO-5 is the preferred option.

Do you live in Southern Maine and have questions about your Maine homeowners insurance? Are you buying a home in Southern Maine and want insurance advice? Call a Noyes Hall & Allen Insurance agent. Or, you can create your own Maine home insurance quotes online in 10 minutes. We offer a choice from many preferred insurers. We’re independent and committed to you.