One of the biggest decisions you will make when starting your business is selecting the right commercial insurance to cover your office equipment. Business insurance adds a layer of protection in the event of a covered loss. Some of the covered losses that your insurance protects you from include fire and theft. Your insurance policy will cover most items owned by the business, including office equipment.

How To Get The Right Coverage

When you start to look for business insurance, there are a few things to keep in mind. Find a commercial insurance agent you trust in your area. They’ll help you select the type of coverage your business needs, and avoid coverage you don’t. A good agent can help match you with an insurance company that understands your business. Make sure your policy includes all business assets. One way is to look at your balance sheet and make sure that you have enough coverage for inventory and equipment. This helps prevent gaps in your coverage that could lead to losses.

Documenting Office Equipment

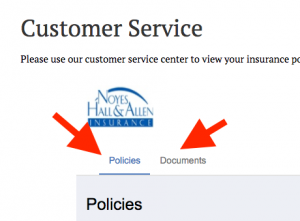

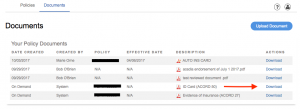

It is important to include your office equipment in your coverage. One way to ensure that you adequately protect valuable office equipment is to save receipts or check your balance sheet. Photocopy all of your documents that figure into your insurance policy and keep them stored in a separate location or in the cloud. One highly respected insurance company that can help you step by step through the coverage process is Noyes Hall & Allen Insurance in Portland, ME.

If you are looking for high quality and reliable commercial insurance, call Noyes Hall & Allen Insurance in South Portland, ME at 207-799-5541. One of our knowledgeable agents will be glad to answer your questions and help you get started protecting your investment today. We represent several insurers, so we can help you choose the best value. We’re independent and committed to you.

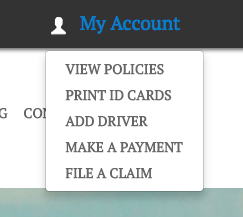

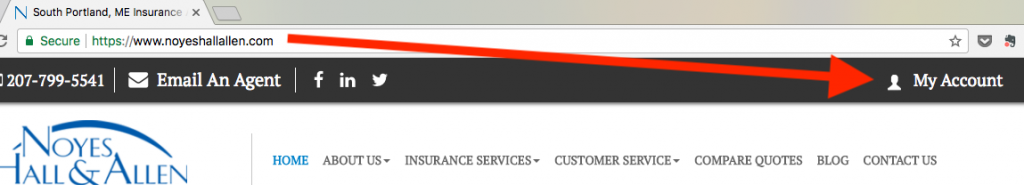

Look for the “My Account” icon on the upper right of the page (or in the list on a mobile phone). It opens to a drop-down menu. Select an option.

Look for the “My Account” icon on the upper right of the page (or in the list on a mobile phone). It opens to a drop-down menu. Select an option.