Does Maine personal auto insurance automatically cover a new vehicle? Many clients wonder about this when they purchase a new car on the weekend or after work, when their agents’ office is closed.

The answer varies, but most preferred auto insurance companies in Maine automatically cover a new vehicle if you have an existing policy.

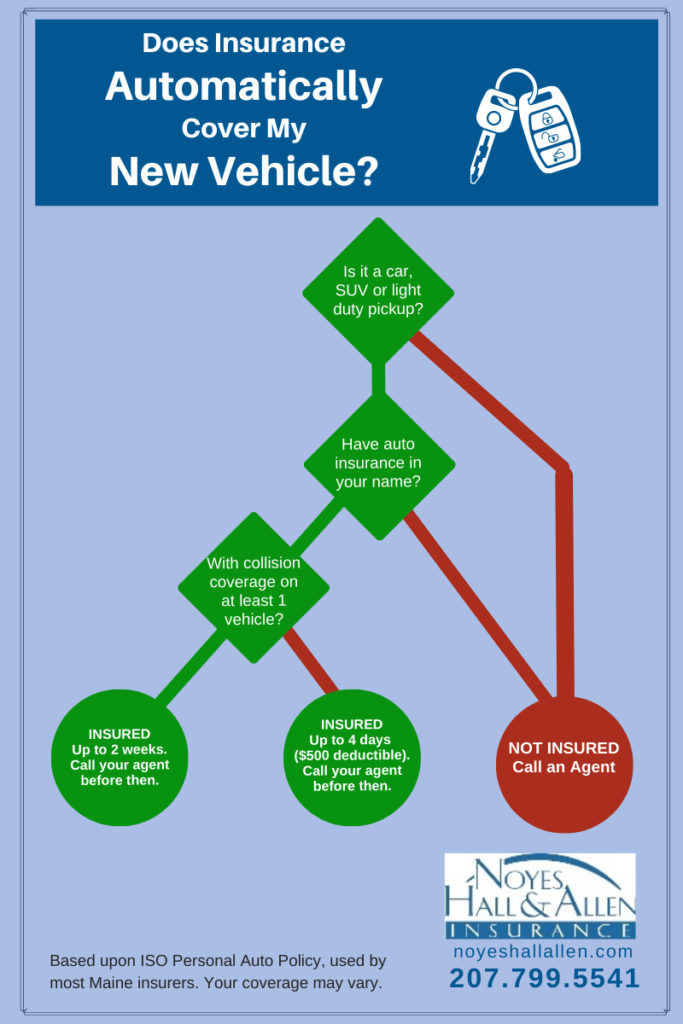

Most companies that sell insurance through a Maine Trusted Choice Independent Insurance Agent like Noyes Hall & Allen use policy forms written by Insurance Services Office (ISO). This infographic outlines the automatic coverage for new vehicles in an ISO Personal Auto Policy. Your policy may be different. Check with your agent if you’re not sure.

Your Policy May NOT Automatically Cover a New Vehicle

This information is for personal auto policies only. Most commercial insurance policies do not automatically cover new vehicles. Be sure to check with your business insurance agent if you’re buying a new vehicle for your business or organization.

Many Maine insurers don’t use ISO forms, even for personal policies. These include Progressive, State Farm, Allstate and GEICO. If you’re insured by one of those companies, call your insurer to find out how they treat new autos.

For example, Progressive’s auto policy appears to match coverage to the old vehicle when you’re replacing a car. If you replaced an old vehicle that didn’t have collision coverage, the new vehicle won’t be covered for collision until you notify Progressive. GEICO’s auto policy appears to have the same restriction. State Farm’s policy doesn’t appear to distinguish between an additional vehicle and one that replaces a vehicle on the policy.

What Info Your Agent Needs

If you’re planning to pick up a new vehicle outside business hours, check with your insurance company or agent. For answers to these and other insurance questions, contact Noyes Hall & Allen in South Portland Maine.

If you’re already a Noyes Hall & Allen client, you can notify us about vehicle changes from our Client Center, or use the links below to text or email photos of your VIN and lender or lease information.

We’re independent and committed to you.