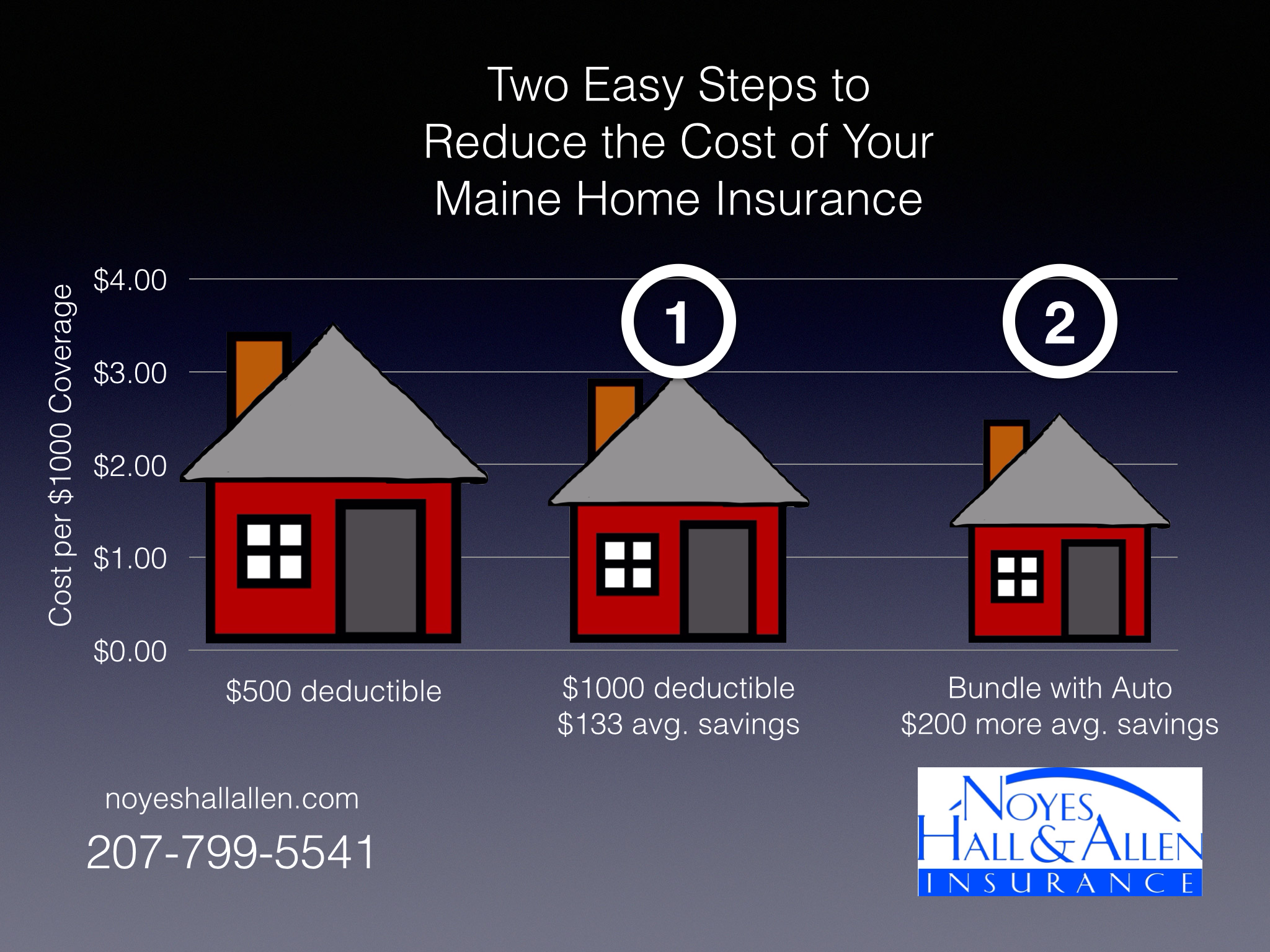

Two Easy Steps to Save Money on Maine Homeowners Insurance

Our Portland Maine area insurance clients save an average of $133 per year on Maine homeowners insurance when they increase the property deductible from $500 to $1,000. It was once common to have a $500 deductible, but many clients think it’s smart to increase to $1,000 now for three reasons:

- They wouldn’t make a $500 claim anyway. Most people save their insurance for larger problems. They wouldn’t file a claim for less than $1,000. They know that insurance companies do look at claim history when pricing insurance, and they want to only file a claim when they really need to.

- Inflation has made a $1,000 the rough equivalent of what was a $500 years ago, when they bought their home insurance. It only makes sense to adjust their policy.

- It usually saves money in the long run. The average savings payback is a little less than 4 years. Most people don’t file a homeowner claim more often than that.

Noyes Hall & Allen clients also save an average of $200 more when they bundle their Maine home and auto insurance. Because insurance companies in Maine offer discounts on both home and auto insurance when you insure both with them, you can probably reduce your auto insurance costs by bundling as well. In addition to saving money, packaging your home and auto coverage provides other benefits:

- Only one person to call for all your insurance. If you move, change bank accounts, or have a question about your insurance, you only need to remember one contact.

- More clout with the insurance company. Insurers often give more favorable treatment to clients who place more business with them. Some offer member benefits or better coverage to package clients; others offer the simplicity of combined billing and other correspondence; all of them are more inclined to give a long-term multi-policy client the benefit of the doubt in a sticky situation.

Would you like a review of your personal insurance program? Contact a Noyes Hall & Allen agent at 799-5541. We represent several of Maine’s preferred insurance companies, so we can find the best value combination for your unique situation.