Commercial insurance is requisite for any business in the modern world, including start-ups. In fact, new businesses or start-ups have the most to lose if things go south. Therefore, it’s vital to protect yourself in the best possible way – including getting commercial insurance. In Maine, this type of coverage is not mandated, but if you are serious about running a successful business, you need to get it.

Purchasing commercial insurance might be the difference between death and survival for your start-up. If you are planning to open a new business in The Pine Tree State and need coverage, Noyes Hall & Allen Insurance in Portland, ME is the place to look. We offer the following commercial insurance coverage options for start-ups:

- General Liability Insurance for Start-Ups. GL pays for losses arising from settlements, claims, or lawsuits that your start-up may face due to injuries or property damage caused to third parties.

- Professional Liability Insurance. Many creative and tech startups would face disaster if sued for copyright infringement, programming error, printing mistakes and other gaffes. Professional liability insurance protects you and your reputation by defending you and paying damages you might owe.

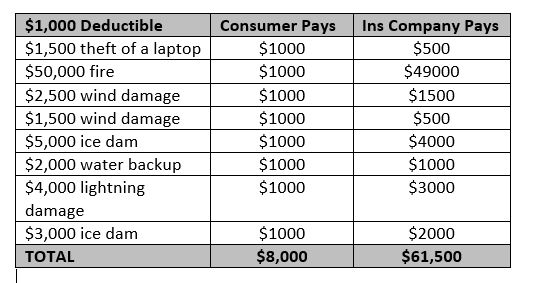

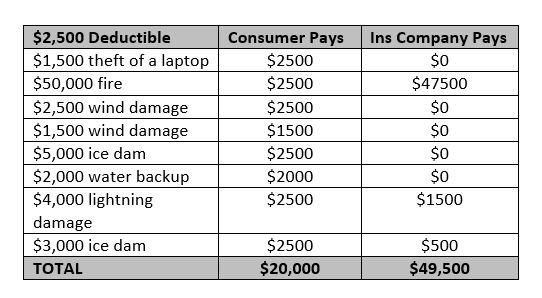

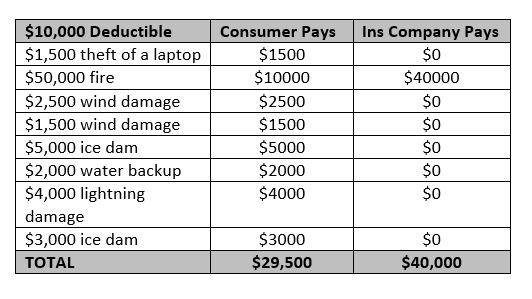

- Property Insurance for Start-Ups. This covers physical assets owned by your start-up. This includes your investments in inventory, structures, equipment and company vehicles (commercial auto insurance). Damages caused by wind and hail storms, fire, smoke, collision and vandalism fall under this category.

- Flood Insurance. Flood damage isn’t covered by business property insurance. That’s why you need flood insurance for your start-up. Remember that flooding can occur anywhere, anytime. It helps to be covered from the resultant losses.

- Workers Compensation Insurance. In Maine, if you have employees, you’re required to provide workers comp insurance. Your employees are an essential part of your business. Ensure that they are taken care of in case of an accident that results in injury, disability, or missed work.

Other coverage options are available, but these are the most important. Commercial insurance is the best way to make sure that your business doesn’t go under after an unfortunate event. For more information on commercial insurance from Noyes Hall & Allen Insurance in Portland, ME, call us at 207-799-5541, or visit our website to get the answers you need.

Which Car Insurers Won and Lost in 2017?

Which Car Insurers Won and Lost in 2017?