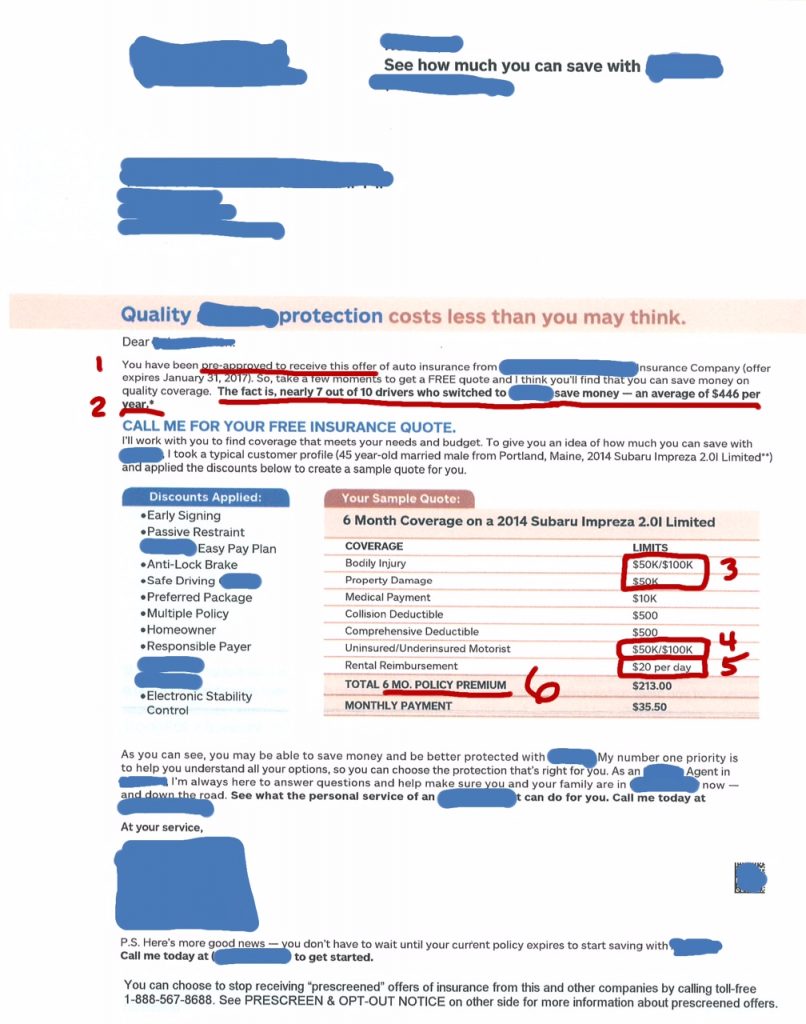

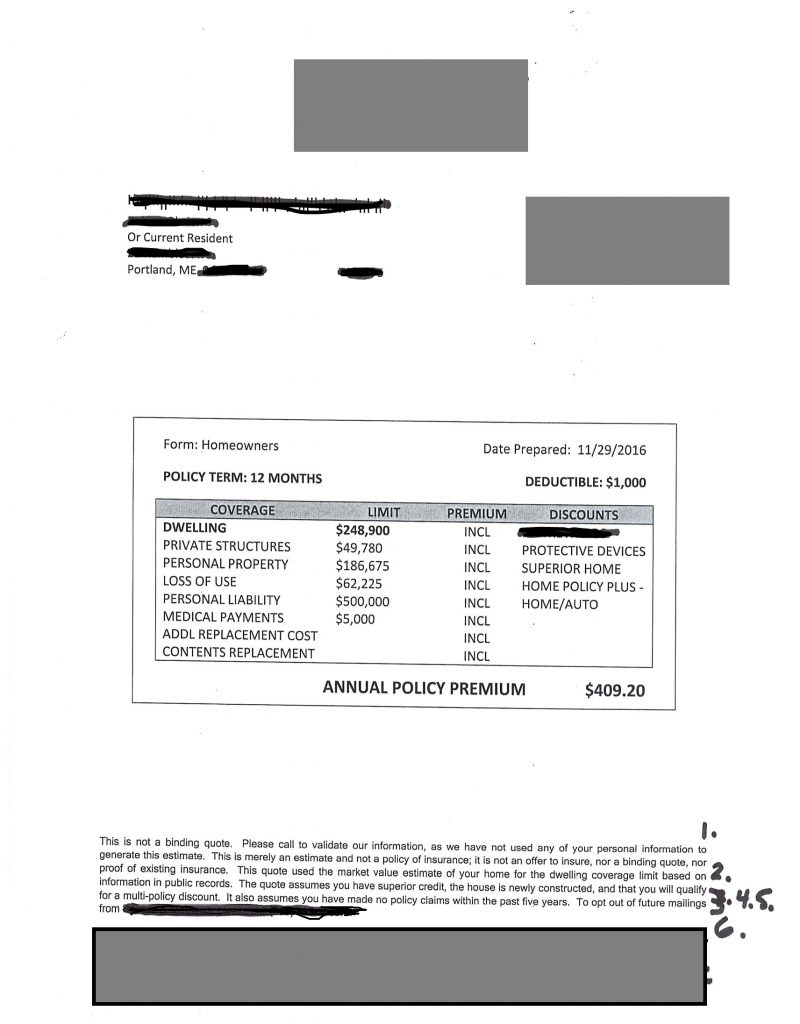

One of our employees received this solicitation from a competitor. It quotes a homeowners premium of $409 per year. That’s hundreds less than they pay now. How can that be? Is this “bait and switch”? Like most of these offers, if it sounds to good to be true, it probably is. The answers are in the fine print.

Example: 6 Cheap Homeowners Insurance Quote Tricks

1. Using the “Perfect Profile”

Every insurance company uses personal information to provide an accurate quote and policy for you. This may involve your insurance history, your insurance score (similar to a consumer credit score), your occupation and more. If you get a quote out of the blue without giving any of your information to anyone, you’re getting a generic quote, probably containing the absolute best rate, reserved for the theoretical human who fits the perfect profile. No one gets that rate.

2. Quoting On the Tax Assessor’s Value of Your Home

Tax assessments have nothing to do with insurance. Towns and cities revalue every several years to create a “just baseline” to compare properties for tax purposes. If it’s been years since the last revaluation, the figure is probably low. Assessed value has nothing to do with the cost to rebuild your home. Assessments are roughly based on market value, which is affected by location, condition, and acreage.

After a disaster, you want to have enough insurance to rebuild your home. Insurance companies want that, too. That’s why they require you to insure 100% of replacement cost. Usually, assessed value is far below your home’s replacement cost. For example, this home’s replacement cost is 20% more than the quoted amount. If they called for quote, the insurer would take information about their home, calculates its replacement cost, and bump the amount by 20%. That would increase the price.

This insurance company knows all of that, but chooses to ignore it. The lower amount means a cheaper quote. It’s appealing – until you think about it.

3. Inflating Your Insurance Score

As explained above, insurance companies use scoring to price your insurance. The higher your credit score, the lower your insurance price. This quote assumes that you’re in the top tier of insurance scores. Even people with excellent credit scores may not make the “superior credit” status. So, when you respond to the solicitation, your price probably goes up.

4. Presuming Your Home Was Just Built

This home was built in 1972. The tax assessor’s document clearly says that. Why would the insurance company quote it as if it was new? Because there’s a “new home discount”. That makes the rate lower, until you call in. Oops, no discount for you.

5. Assuming You Move All Your Insurance

It’s no secret that you can get a lower price with most companies by bundling auto and property insurance. You should absolutely talk to your agent about bundling to see if it makes sense for you. It doesn’t always. What if this company’s car insurance rates are terrible? What if you don’t meet their underwriting requirements? What if…?

Without a package discount, this quote could be 20% higher – or more. And, think about it: if this insurance company uses shady quoting tactics on your home insurance, do you really want to trust them will ALL of your insurance?

6. Have You Really Had No Claims in 5 Years?

Maybe that’s true, maybe not. Five years is a long time. Many people forget that they’ve had claims. You could think it’s true, until the insurance company runs their reports. That plumbing leak? The water backup in the basement? Oh yeah. Those count. And, they can change this quote considerably.

Looking for a Real Maine Homeowners Insurance Quote?

If you are looking for homeowners, condo or renters insurance in Maine, and want a thorough review and a realistic proposal for your coverage, contact a Noyes Hall & Allen Insurance agent. We’re independent, so we offer a choice of preferred insurers in Maine. Prefer to start online? Get up to 6 Maine homeowners insurance quotes in 10 minutes on our web site. If that’s as far as you want to go, we won’t hound you later. But, we’re happy to answer your Maine home insurance questions.