Organized Retail Crime is widespread and on the rise, according to a recent survey by the National Retail Federation. A record 96% of the 125 retail survey respondents reported being the victim of organized retail crime in the past year, and almost 88% said that Organized Retail Crime had increased in the past 3 years. The survey respondents cited special concerns in cargo theft, fraudulent returns or gift cards, and collusion.

Organized Retail Theft in Maine

Maine retail business insurance clients have not been immune. From the Maine Mall to Main Street, Portland to Maine’s most rural outpost, clothing shop to convenience store, business insurance claims for theft are filed every day.

Organized theft is a special problem says Curtis Picard, Executive Director of Maine Merchants Association. “These are not people stealing to feed their families; these are not crimes of convenience. These are groups or gangs purposely stealing specific items with the intent to resell them and they do hit Maine.”

Organized retail theives don’t target a specific store. They target specific items. They want higher value items that are widely used and easy to steal in quantity. Popular targets are baby formula, over the counter medications and believe it or not, Tide Laundry Detergent.

“The internet has made it so much easier to resell these items. Search Prilosec or Crest White Strips on a site like eBay; you will see numerous listings for these items featuring ‘new in box’ or ‘original packaging’. Chances are these items were stolen”, Picard says.

Employees of a well-known store in Kittery can sometimes spot vans unloading several individuals who spread out to hit multiple stores at once, Picard says. It doesn’t matter where your store is – only what you sell. If your store has the items they are looking for, you may be a target.

Retail Fraud in Maine

Theft of items is only one problem, according to Picard. “UPC Code swapping, fake receipts and gift card theft are other forms of Organized Retail Crime. Thankfully, Maine retailers and law enforcement maintain a good relationship and get together at various times during the year to share information about groups. That cooperation has lead to more arrests and better prevention.”

Maine Merchants’ web site has .pdf copies of Maine Police Intel Bulletin for Retail, that provide some examples, including:

- Pharmacy thefts in Southern and Central Maine

- Convenience store and credit union robberies in Portland

- Burglary in Fort Kent

- Electric motors stolen in Oxford County

- Burglaries in Freeport, New Gloucester and other areas.

Unfortunately, the funding for that crime bulletin has dried up, according to Picard. Yet the risk to Maine retailers remains.

Protect Your Retail Business Against Crime

Educate Yourself and Your Employees – Thieves are constantly adapting and trying new techniques. Joining an organization like Maine Merchants can help you keep on top of trends through newsletters, meetings and other communications.

Get Involved in Your Neighborhood – Membership in a neighborhood business association like Portland’s Downtown District, South Portland Buy Local or the South Portland Waterfront Market Association opens a channel for you to communicate and collaborate with other businesses in the area. It’s a great way to stay on top of changes in your neighborhood, from street construction to crime trends.

Protect Your Business – Invest in an alarm system. Install video cameras in areas where cash or high-value inventory is kept. Improve the lighting around your premises. Move target items to visible areas where you can keep an eye on them. Better yet, lock them up. Establish a policy to assure that employees are visible and vigilant in your store.

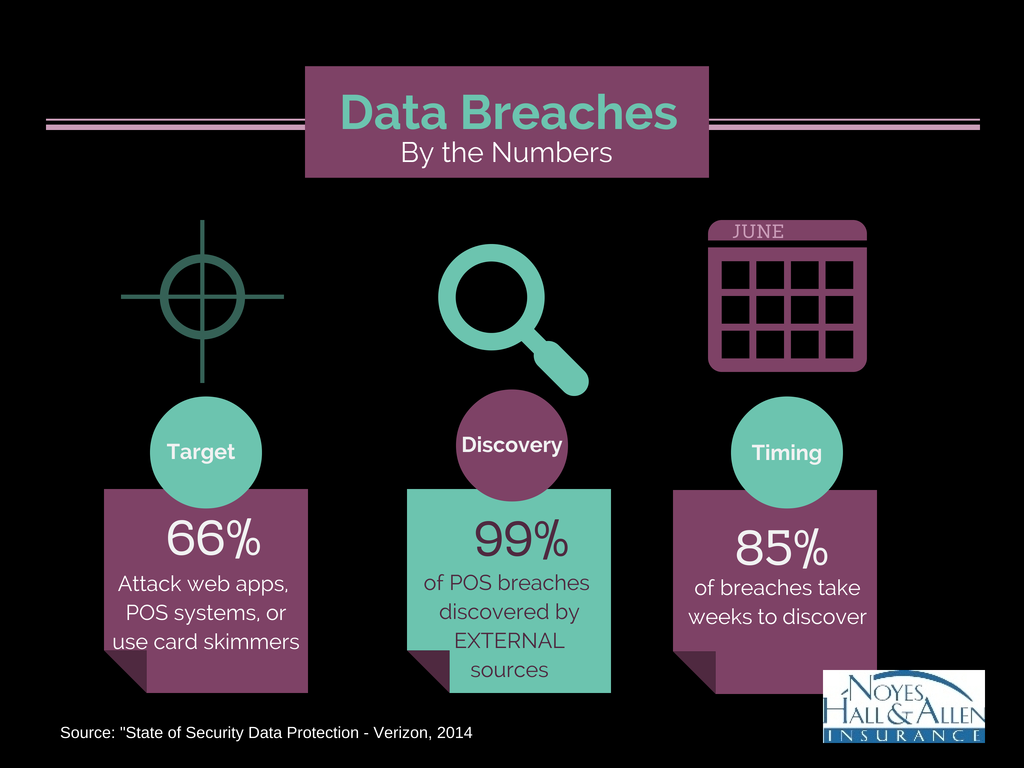

Buy the Right Insurance – Fortunately for most Maine business, property insurance is widely available to cover the peril of theft. Most smaller Maine retailers purchase a Businessowners policy, which provides a bundle of commonly-needed coverage to protect them against theft and other property and liability perils. Larger retailers usually purchase a Commercial Package Policy. These can provide similar coverage, but are more customized to the individual business.

If you are a Maine business owner or manager and have questions about business insurance, contact a Noyes Hall & Allen agent at 207-799-5541. We represent many different commercial insurance companies and can help you find the right fit for your business. We’re also a founding member of the Katahdin Alliance, a group of independent Maine insurance agents with offices from York to Augusta, Kennebunk to Carrabassett Valley. So, if your business extends beyond Greater Portland, we can support you.