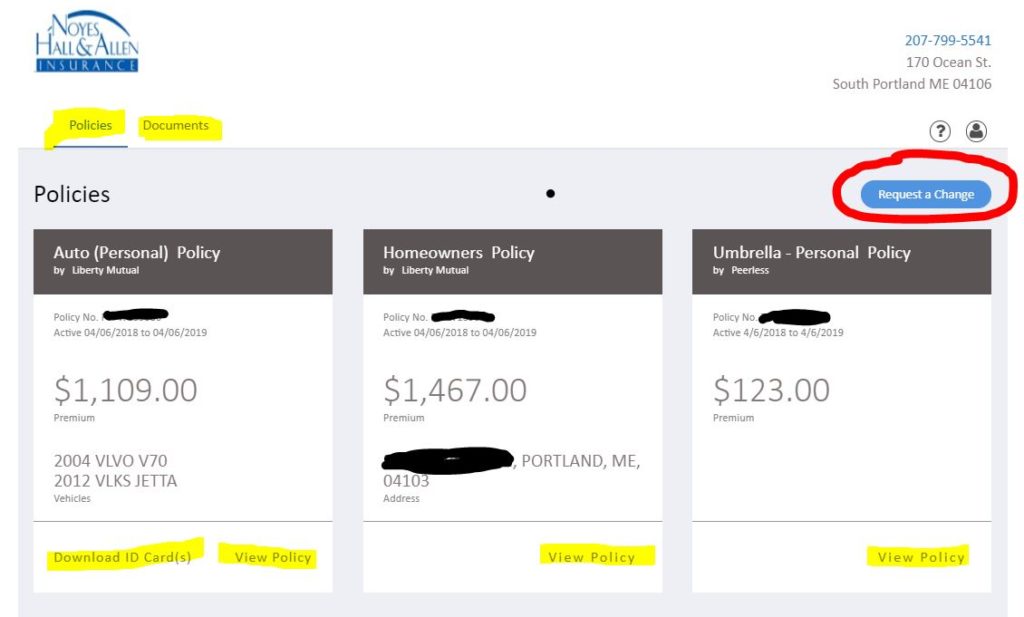

Even if you just started up your small business in the Portland, ME area, it is a good idea to sit down with one of our friendly agents at Noyes Hall & Allen Insurance to make sure you have the coverage you need. Maybe you are using your personal van, truck, or SUV to save on capital expenditures. If so, your personal auto insurance might not fully protect you or your business. You may need commercial auto insurance.

Making Deliveries in Your Own Vehicle?

If you are delivering goods to clients in your vehicle and cause an accident, an injured party may go after your personal assets as well as your business. A commercial auto insurance policy would provide the liability protection your growing business needs to stay afloat.

Sending Someone for Business Errands

Do you ever send someone to get supplies, tools, or even lunch, using their own vehicle? That’s a business use. Your business can be sued for any injuries or damage they cause. Of course, if you have employees, you need to purchase workers compensation insurance to pay their medical bills and lost time.

Driving the Crew to a Job

When you are the boss and are offering transportation in your SUV to your workers, it becomes a business vehicle. Make sure that you carry sufficient coverage for liability and medical expenses if something goes wrong.

When starting a business, it’s important to control expenses. But improper insurance takes big chances with your personal investment. By purchasing the right commercial liability, auto, and workers compensation insurance, you allow your Portland, ME business to grow instead of being bankrupted by a lawsuit or other disaster.

Give our agents a call at Noyes Hall & Allen Insurance for more tips and the right coverage today.