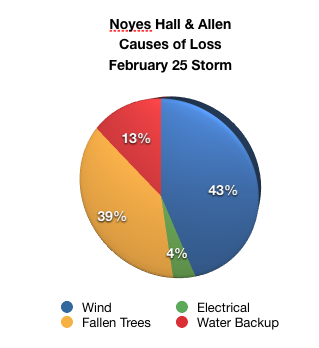

Hurricane Irene visited Maine yesterday. Fortunately, the southern Maine wind damage was mostly limited to fallen trees and limbs – at least judging by our clients who contacted us to report an insurance claim.

The most common claim question today is “A tree fell on my house. Can I remove it, or do I have to wait for the insurance company to inspect it”? As this prior post explained, fallen trees aren’t always covered by insurance. But, if a tree lands on your home or other structure, your homeowners or business policy probably covers both the damage it causes and the cost to remove it.

Generally, it’s fine to remove the tree from your home or driveway to assess the damage and to make temporary repairs to preserve your property. You don’t need to wait for the insurance adjuster to see it; they can usually tell what happened by the scars that the tree or limb left behind.

5 Things to Do if a Tree Falls on Your Property

- Document the damage with digital photos or video.

- Take action to preserve your property from further damage. Remove the tree from the structure, make temporary repairs, or move property indoors.

- Save damaged property for the insurance company to inspect.

- Schedule – but don’t begin – permanent repairs. Repair contractors are very busy after a natural disaster. The earlier you schedule your job with a reputable, experienced and insured contractor, the better the chance of your property being repaired faster. Do not start repairs until the insurance company has a chance to see your damage.

- Report your claim. Noyes Hall & Allen clients can contact an agent to start the process.

If you have questions about Maine homeowners insurance, condo insurance, renters insurance or insuring your Maine business property, call Noyes Hall & Allen at 207-799-5541.