Maine’s property crime rate is a fraction of most states. We’re very fortunate to live in such a safe area. Even Portland, Maine’s largest city, has a property crime rate only slightly above the national average, and far below most U.S. cities. Sadly, crime still does happen in Maine. Many of our clients choose to protect their property by installing a burglar and fire alarm. Some include low temperature alarms, water flow alarms and other protective systems.

How Much Will an Alarm System Save on Home Insurance?

Let’s put it this way: you would never purchase an alarm system for the insurance discount. You purchase it for peace of mind and to protect your valuable property. But, if you’re going to install an alarm, you might as well get the home insurance discounts you deserve, right?

Which is the Best Alarm System for Insurance Discounts?

This list is ranked roughly from the smallest discount to the largest. Savings are based upon the average Maine homeowners insurance premium of $800 per year.

Smoke Detectors – $16

Working smoke and carbon monoxide detectors are the absolute minimum that every home, condo or apartment should have. Smoke alarms save lives. They also save money on home insurance – although very little. There is usually no discount for carbon monoxide detectors. The discount isn’t usually affected by whether your detectors are hard-wired or battery operated, nor how many there are in your home.

Local Burglar Alarm – $16

If you have a bell or siren on the outside of your home that’s connected to an intrusion detection system, most insurance companies will give you a small discount.

Freeze Alarm with Auto-Dialer – $24

This alarm alerts you when temperatures drop below a certain minimum. These are becoming more common with “smart home” systems, and “the internet of things”. There’s no human intervention or monitoring system; the effectiveness depends upon the person answering the phone call and actually doing something about the problem.

Central Station Fire Alarm – $40

This type of alarm is hard-wired and calls a service that’s monitored 24 X 7. If the alarm goes off, the service notifies the fire department. This is considered by most insurers to be a “top shelf” protection plan.

Freeze Alarm with Central Station – $40

This is like a hybrid between the auto-dialer freeze alarm and the central station fire alarm. In a low-temperature event, the monitored service is notified and contacts your heating contractor for emergency service.

Water Flow Alarm with Central Station or Auto-Shutoff – $40

Some of the most expensive winter claims are caused by water running for an extended time. Water damage is also a lot more common than theft or fire. Whether caused by a broken pipe, freeze-up, or a washing machine hose that lets go, water damage and cleanup can be extremely costly. If water stands for an extended time (like when you’re on vacation, or someplace warm in the winter), mold can develop. It’s no wonder that insurance companies reward people who install protective devices to minimize the chance of this type of damage.

Central Station Burglar Alarm – $40

This is like the central station fire alarm, except for burglary. If someone breaks into your home, the monitoring service contacts the police department. Note that the central station alarm credits are additive. If you have a burglary, fire, water flow and low-temperature central station system, your discount might be $160 per year.

Hard-Wired Emergency Generator – $40

Many Mainers purchased generators after Ice Storm ’98, when many towns were without electricity for days. Some insurers offer discounts for permanently installed hard-wired generators. These devices “kick on” automatically when power is interrupted, and require no human intervention. They power the most essential electrical services of a home, including the furnace or boiler, well pump and kitchen appliances. Obviously, maintaining heat during a winter storm can help avoid a costly freeze-up. Certain insurers reward that by providing a discount.

What’s the Best Insurance Company for My Maine Home?

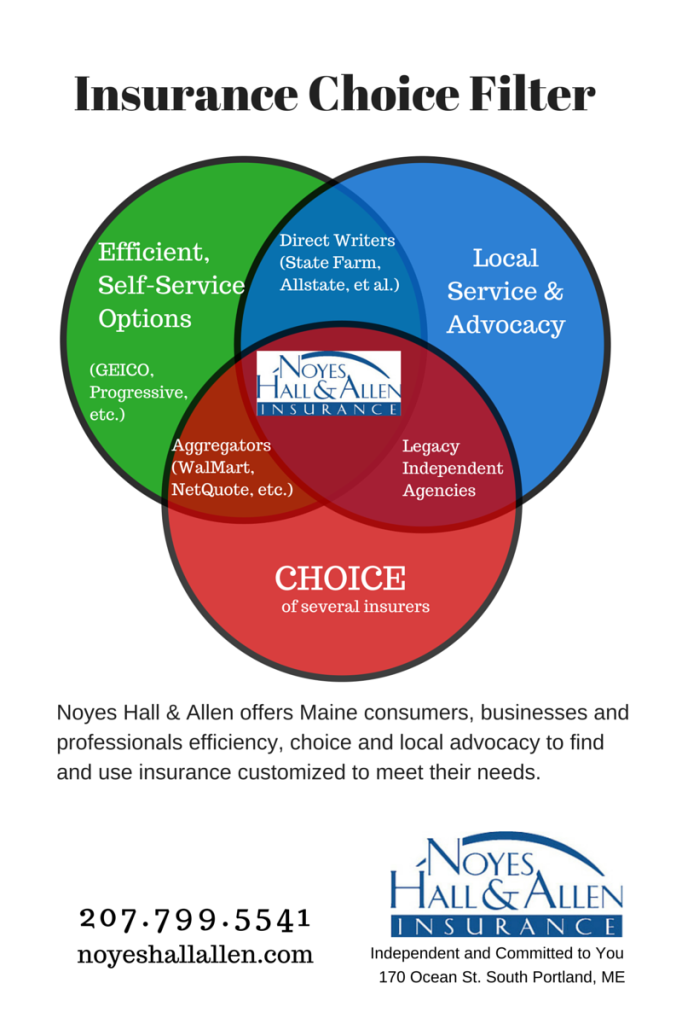

The answer depends upon the unique features of your home: its location, construction, protective systems and more. It also depends upon your family. Do you have pets? A swimming pool? Are you near the coast? As an Independent Agent, Noyes Hall & Allen Insurance offers a choice of several preferred Maine homeowners, condo and renters insurance companies. We can help you find the best match. And, if your needs change, or the insurance company does, we can help you find another – without having to switch agents. Contact a Noyes Hall & Allen agent in South Portland at 207-799-5541, and find out why we say we’re “Independent and Committed to You”.

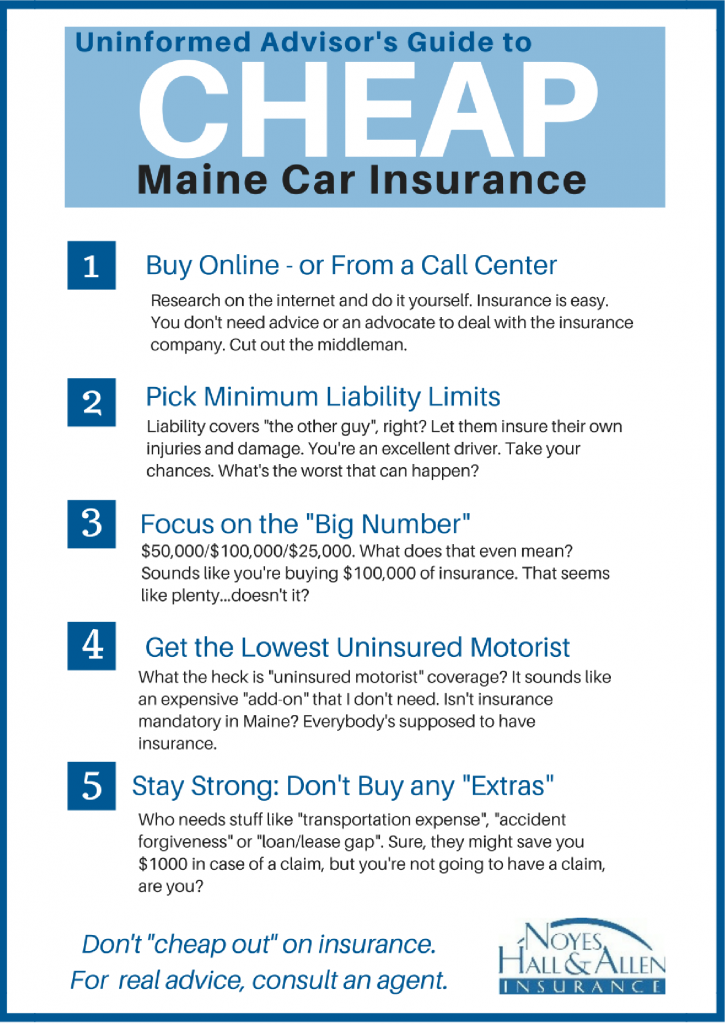

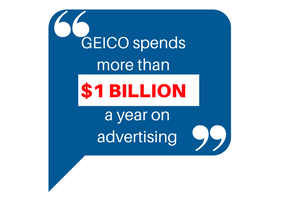

State Farm, Geico, Allstate and Progressive all sell directly from company to consumer via the internet and inbound call centers. If you contact them, remember that you’re talking to an insurance company employee. You’re accessing information prepared, controlled and presented by the insurance company. Expect that they will look out for their own business interests first.

State Farm, Geico, Allstate and Progressive all sell directly from company to consumer via the internet and inbound call centers. If you contact them, remember that you’re talking to an insurance company employee. You’re accessing information prepared, controlled and presented by the insurance company. Expect that they will look out for their own business interests first.