Rate Increases, Cancellations and Coverage Reductions – What You Can Do About It

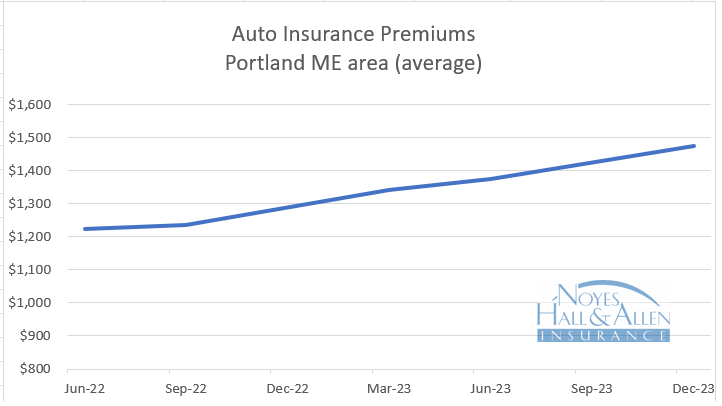

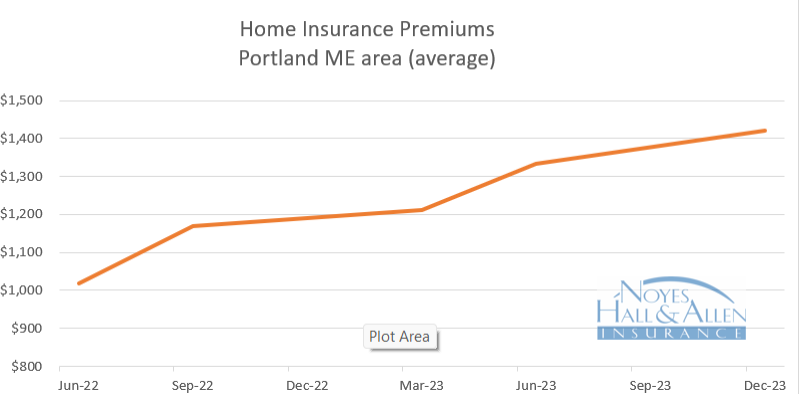

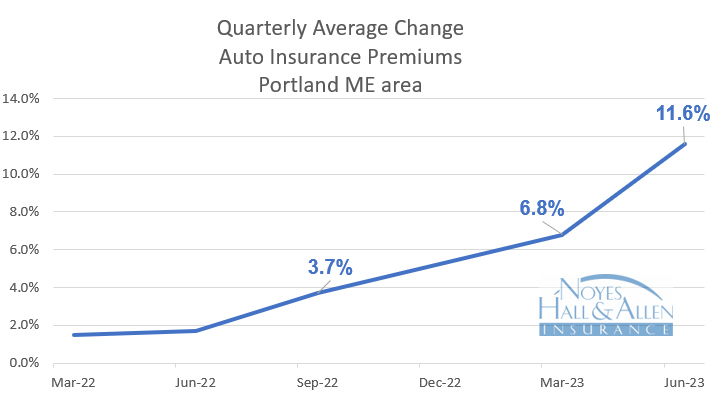

It’s clear that Maine property insurance is facing challenges in 2024. Homeowners are feeling the impact. Rising rates, policy cancellations and coverage cutbacks are common. It’s not just a coastal problem. People all over Maine are discovering that insurance underwriters hold the cards in this market. How and why is the insurance market so hard right now? Do you have any recourse? What can you do to control costs?

What’s Going on in the Maine Property Insurance Market?

Why Property Insurance is So Painful in 2024

There are many reasons, but they all come down to cost. Insurance is designed to share costs and spread risk. Claims of the few are paid by the many through insurance premiums. Insurance companies are well-funded. They have reserves to pay out more than they collect in premiums for a short time. But those costs are then passed on. Otherwise, the system falls apart and everyone loses.

Insurance claim costs have spiked in many areas for various reasons. They include:

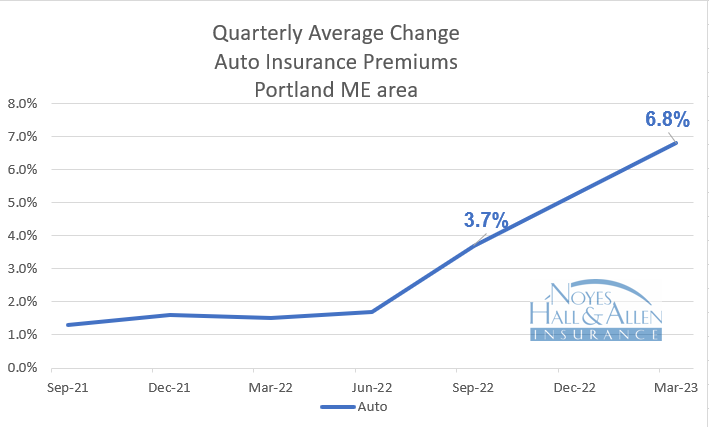

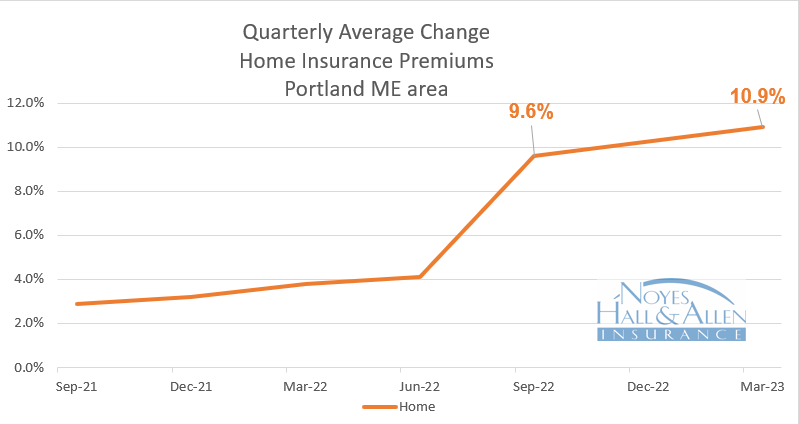

- Inflation in materials – Rising costs for building materials, auto parts, and medical supplies contribute to higher claim expenses.

- Increased claim severity – More frequent and severe weather events, changes in property use, and an increased number of seasonal and secondary properties lead to larger claims.

- Rising labor prices – Worker shortages, wage increases, and legislative impacts affect repair costs.

- Longer repair times – Shortages in parts, materials, and labor result in extended repair durations, impacting expenses for auto rentals, temporary housing, and commercial relocation.

- Reinsurance costs – Insurance companies buy reinsurance to protect themselves from disasters. Shrinking reinsurance capacity since 2020 has led to price hikes for insurers.

Catastrophes Can – and Do – Happen in Maine

Mainers often think that weather disasters happen “somewhere else”. But they do happen here. And lately they’ve been more frequent.

Verisk defines a catastrophe (“CAT”) as an event resulting in more than $25 million in insured losses. Regional insurers may see an average of 4-5 “CAT” events per year in Northern New England. In 2023 there were 8.

There aren’t just more catastrophes than normal. They’re bigger too. Their 2023 expected payout for damage from CAT claims was nearly 8X an average year. We don’t see signs of improvement right away. 2024 started with a major wind and rainstorm.

Changes in Your Maine Property Insurance

Maine property owners are seeing a lot of changes in their insurance. Most of it is not good news. Here are some things you might experience:

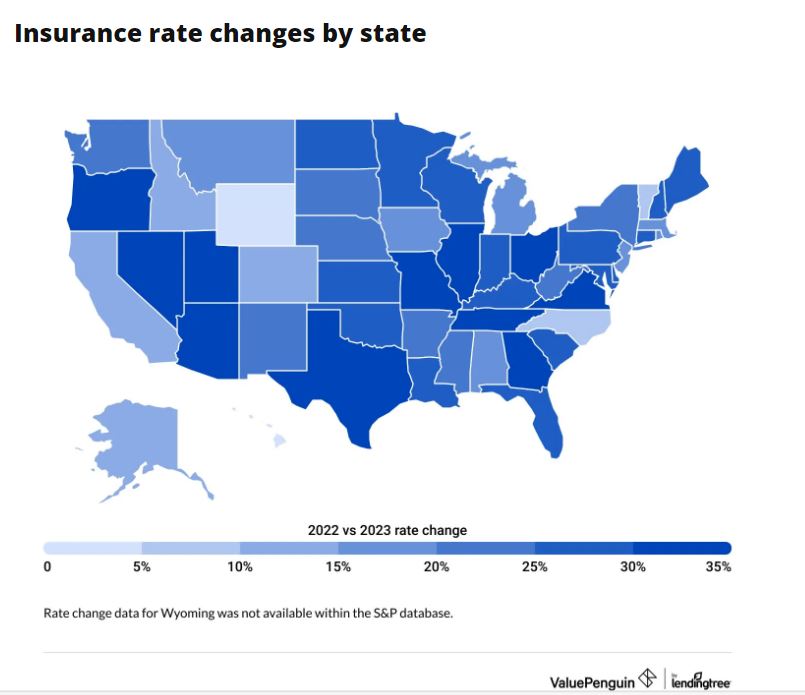

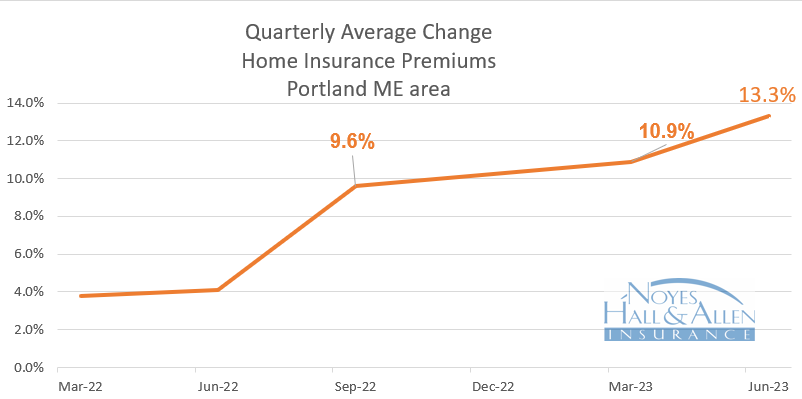

- Increasing rates – Even homeowners with no claims experience are facing rising rates, with the current average increase around 17% in Maine.

- Saying “no” -Moving to a different insurance company during this time can be risky, as many insurers decline to quote on properties they consider higher risk.

- Tougher inspections – Insurers are inspecting properties more often and more closely. They’re focusing on roof condition and overhanging trees. Some are even using aerial photographs to spot hazards.

- Bumping deductibles – Many coastal properties now have big wind deductibles. Some insurers are increasing deductibles across the board. Others are only increasing deductibles if you’ve had several claims.

- Mandatory alarms – Insurers require owners of high value or secondary homes to install central alarm systems to warn against water leakage, low temperature, fire and burglary.

- Required increases in insurance amount – Building material and labor cost increases mean higher costs to rebuild your home. Insurers review that cost periodically and require you to insure to the full rebuilding cost. (Although it costs more, it’s important to make sure you have enough insurance to rebuild – this is a benefit).

- Cancellation or non-renewal – Insurers may cancel policies due to claims or if homeowners fail to make necessary improvements after an inspection.

Is All of This Legal?

The Maine Bureau of Insurance plays a crucial role in regulating insurance companies offering Maine property insurance. Here are some key points:

Rate Approval and Policy Changes

- The Bureau approves rates for insurers authorized to do business in Maine.

- They also permit cancellation or non-renewal for certain reasons. Those reasons include failure to comply with reasonable loss control recommendations or failure to permit inspection.

- Insurers can make changes to policy terms, which is known as a “conditional renewal.”

- If an insurer decides not to renew your policy, they must send you a “legal notice of non-renewal.”

Challenging a Non-Renewal

- As a policyholder, you have the right to challenge non-renewal by appealing to the Maine Bureau of Insurance.

- However, insurers typically adhere to non-renewal rules, making successful appeals less common.

How to Control Maine Property Insurance Costs

Although you can’t completely avoid large market forces, you can do some things to control your Maine property insurance costs and protect your property.

- Pro-actively protect your property – regularly trim trees and shrubs away from buildings. Install a generator or backup sump pump. Keep gutters clean. Use a low-temperature alarm if you’re often away from the property.

- Keep up on maintenance – take care of peeling paint or moss or debris on your roof. Replace roof shingles before you get water damage (hint: like tires, shingles don’t usually last as long as the warranty may say).

- Stay claim-free – Small insurance claims sit on your record for 5 years or more. Many insurance companies decline to insure new properties if they have multiple property claims.

- Watch your credit score – insurers “score” policies to set rates. An insurance score is closely related to your credit score. The better your score, the lower your rate.

- Choose a local insurance agent – Local knowledge can be the difference between getting property insurance and not. National insurers and 800 number agents don’t know your area like a local advocate.

- Communicate with your insurance agent. Let them know if you make improvements, install alarms or generators, or pay off your mortgage. All of those might reduce your insurance premium.

Help Navigating Maine Property Insurance

If you own property in Southern Maine, contact a Noyes Hall & Allen Insurance agent in South Portland at 207-799-5541. We offer a choice of Maine’s top insurance companies. While we don’t control the market, we have a good perspective on current conditions. We can help you find the best fit and value for your property insurance.

We’re independent and committed to you.