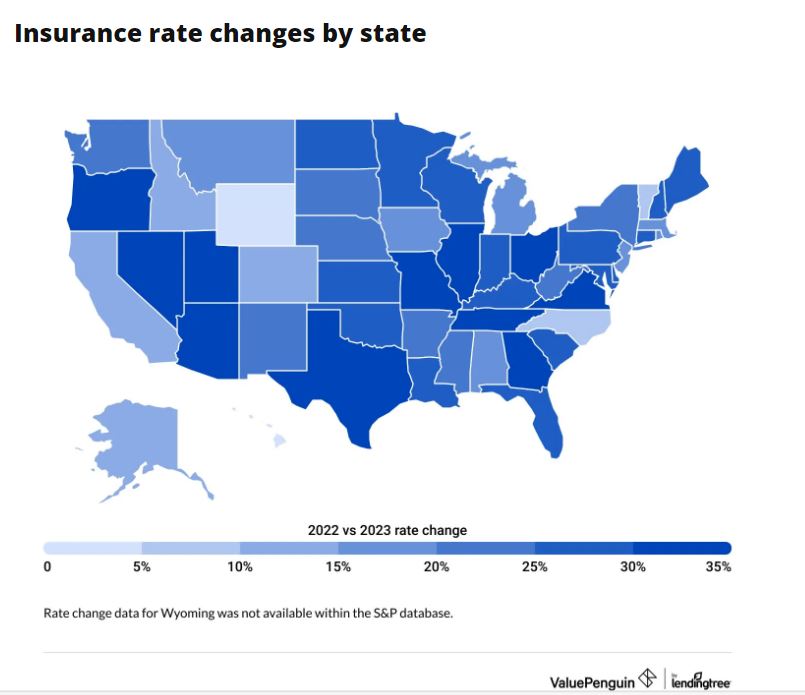

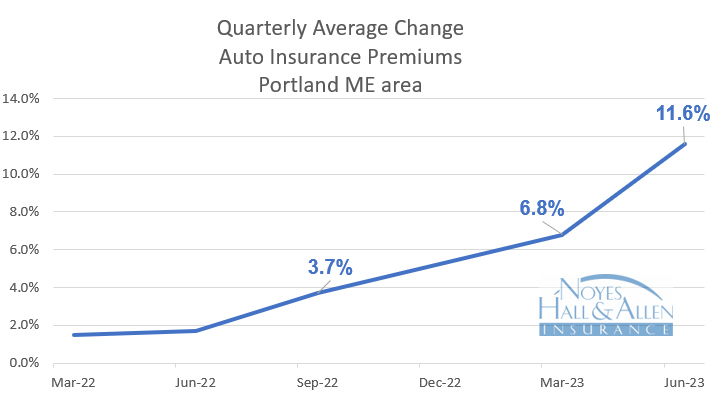

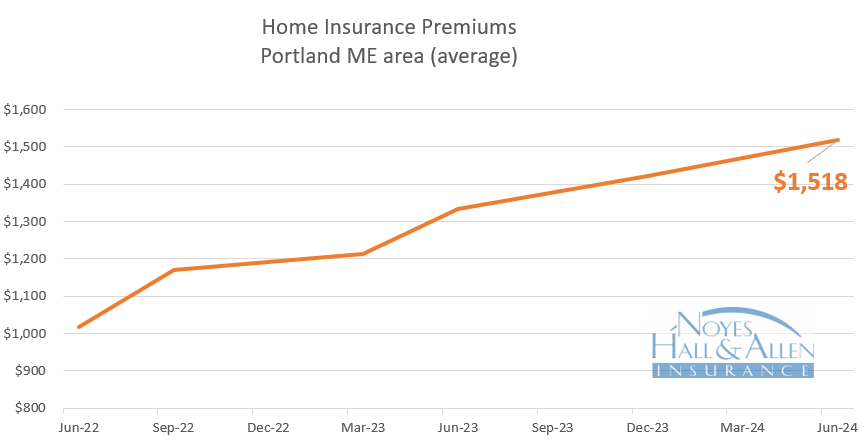

Maine home and auto insurance rates are rising faster than the national average in 2024. Although Maine rates are still among the lowest in the USA, Portland Maine area insurance buyers saw almost a 15% price increase in the first half of 2024. Industry experts expect this to continue through 2024, with some optimism that the increases will be less next year.

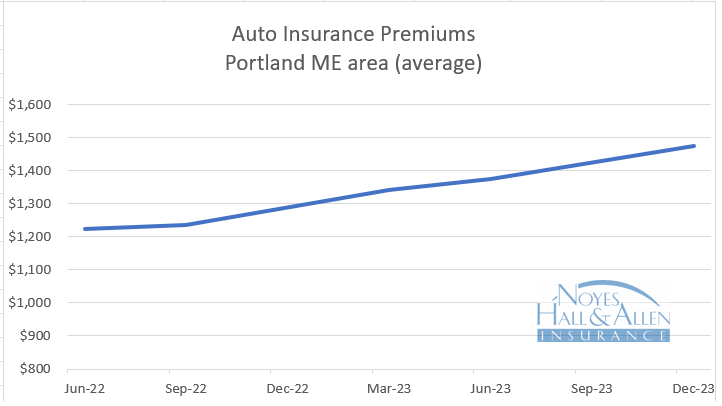

Maine Auto Insurance Rates – June 2024

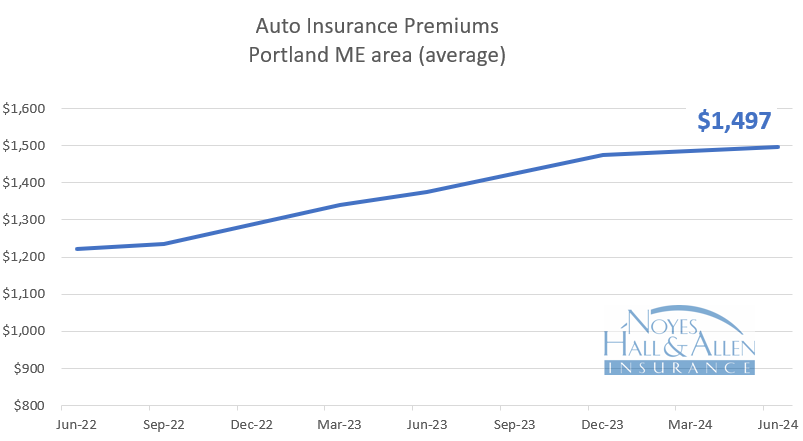

Portland Maine auto insurance rates jumped 13.0% on average in the 2nd quarter of 2024. The average annual auto insurance policy in Cumberland County now costs $1497 per year. Rates vary depending on the type and number of vehicles, drivers and other factors.

The good news is that the average Maine driver pays 44% less than the national average for auto insurance, according to the Value Penguin “State of Auto Insurance 2024” report.

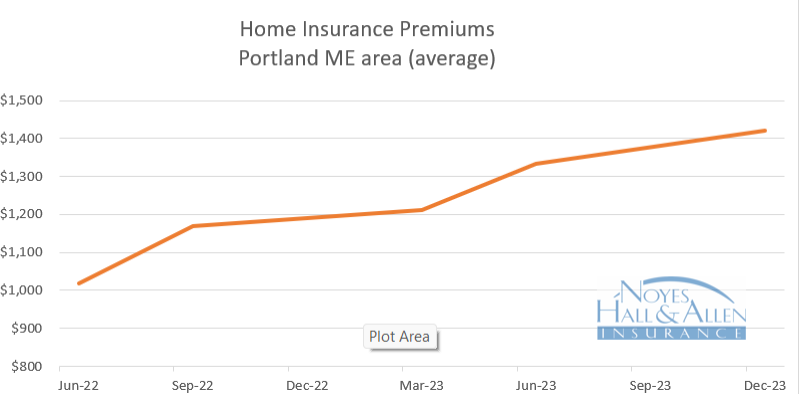

Maine Home Insurance Rates – June 2024

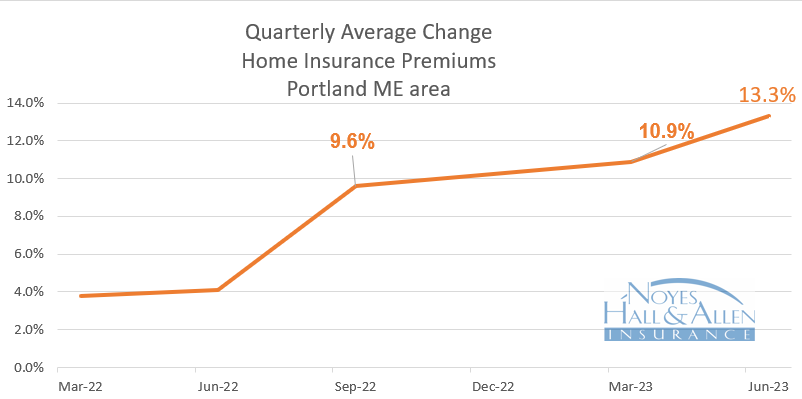

Maine home insurance rates continue to increase even faster than auto insurance. The average home insurance premium was 13.7% higher than a year ago. The end is not in sight yet, as US home insurers report record losses from weather events.

Fortunately, historically high rebuilding costs have tempered somewhat. This allowed insurance companies to reduce their “inflation guard” factors. That reduces the percentage increase, which was about 4 percentage points lower than our last survey in December.

Publications ranging from Portland Press Herald to the New York Times to the Quoddy Tides have documented rising homeowners prices and reduced underwriting availability.

Independent Agents Offer a Choice of Maine Home and Auto Insurance Rates

For more than 90 years, Noyes Hall & Allen has helped southern Mainers navigate the insurance market. While we don’t have any control over prices, we offer a choice of several insurance companies. That means we can help you find the best insurance value in any market.

If you live in southern Maine, you can get up to 5 insurance quotes in 10 minutes from our website. Or contact a Noyes Hall & Allen agent in South Portland at 207-799-5541 for a free no-obligation custom review.

We’re independent and committed to you.