Maine’s growing season is short. Landscapers and lawn care contractors only have a few months to earn money. That means they must watch expenses carefully to be profitable. Too much overhead can be the difference between profit and loss for a Maine contractor.

How Much Does Landscaping Liability Insurance Cost?

Prices vary depending on:

- Whether you specialize or not – pesticide or heavy tree work specialists pay more for insurance.

- How much experience you have – seasoned businesses with good experience pay less than start-ups.

- How much you make – higher revenues means higher insurance costs.

- If you plow in winter – If you take on lots of commercial plowing jobs, you’ll pay more for coverage.

If you’re a single operator in Maine with a mower or two, you’ll probably pay less than $1500 a year. If you have heavier equipment to insure, you’ll pay a bit more.

Do I Need Workers Compensation Insurance for My Landscaping Business?

If you have employees, yes. If not, you may or may not have to buy workers’ comp, depending on the legal setup of your business. For example, if you’re a “dba”, you can choose to cover yourself under workers compensation, but you’re not required to.

Related Post: Who Needs to Buy Workers’ Comp Insurance in Maine?

How Much Does Lawn Care Equipment Insurance Cost?

You can insure tools and equipment like deck mowers, weed trimmers, hand mowers and hedge trimmers on a contractors package policy. The price varies with the value of the equipment. It usually costs less than $3.00 per $1,000 of value. Some policies offer replacement cost coverage (new for old). Other policies cover depreciated value. Ask your agent what they’re quoting.

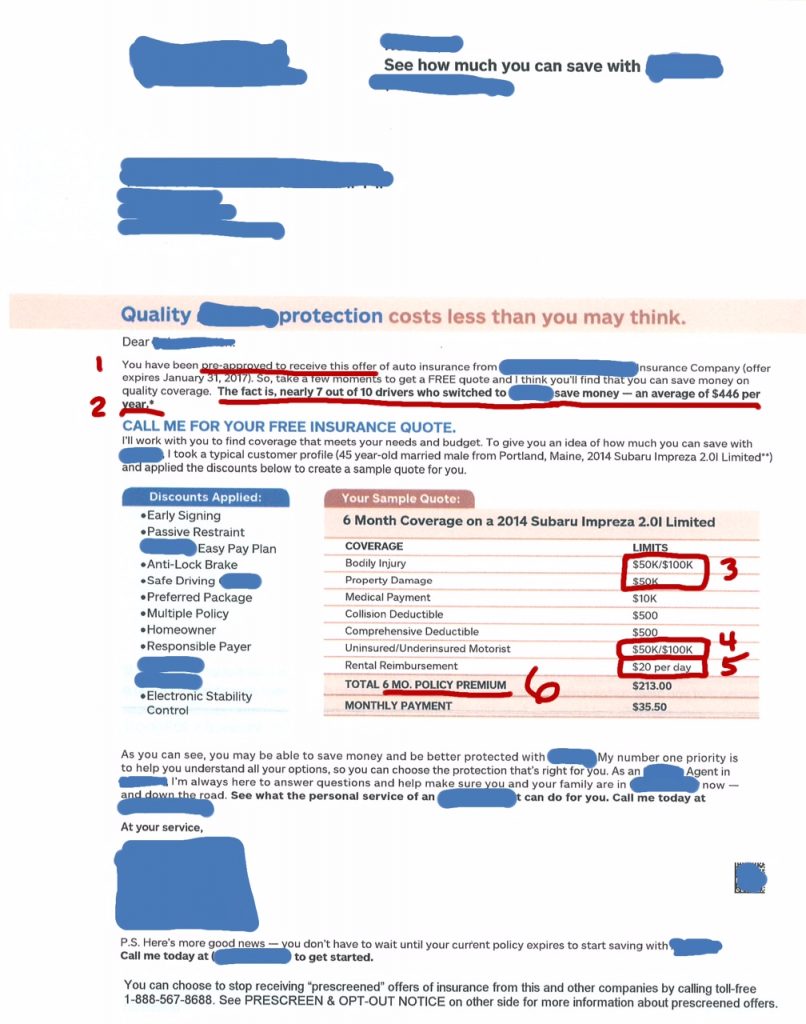

How Much Does it Cost to Insure My Landscaping Truck and Trailer?

Business vehicle insurance costs more than personal. For a brand new 1/2 ton pickup, budget about $1500 per year – more if you plow commercially. Even though it’s more expensive, it’s still a good idea to buy the business policy. You want to be covered properly.

Related Post: Should a Maine Contractor Insure Vehicles in a Business Name?

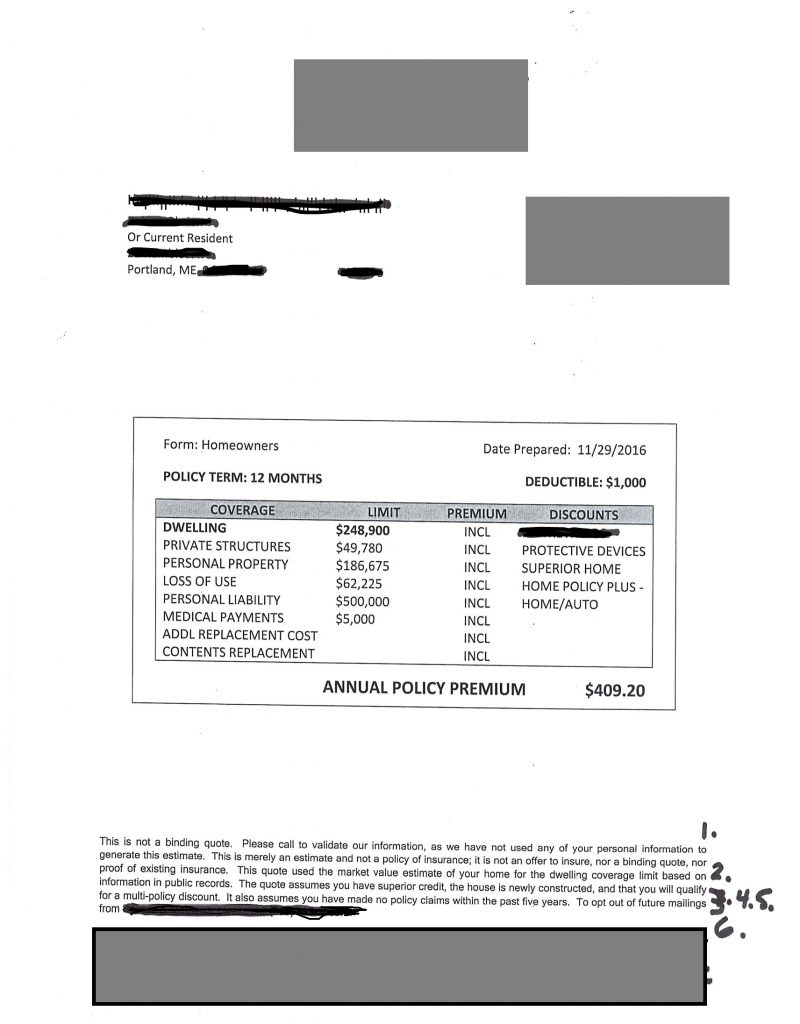

Can I Store My Lawn Care Stuff in My Garage at Home?

Storing fuel or equipment in an outbuilding can VOID COVERAGE for that building on your homeowners policy. If you have gas cans and mowers in your detached garage, and a fire starts, destroying the garage, your homeowners policy will NOT cover the rebuilding cost – even if the mowers or fuel had nothing to do with the fire.

Talk to your homeowners insurance agent about how your policy deals with this. Another option: insure your garage on your contractors policy. You want to make sure you have insurance help to rebuild after a disaster.

Have questions about contractors insurance for Maine landscaping or lawn care business? If you live and work in the Portland Maine area, call a Noyes Hall & Allen Insurance agent at 207-799-5541. We represent many insurance companies, so we can recommend the best value. We’re independent and committed to you.