On November 6, 2012, Maine voters approved citizen initiative Question One, allowing same sex marriage. Yes on One proponents claimed that only marriage, granted LGBTQ couples equality with everyone else. No on One proponents were concerned that a change in the traditional definition of marriage as “one woman, one man” might affect many aspects of life.

How Important is Marriage in Insurance?

In a word, VERY.

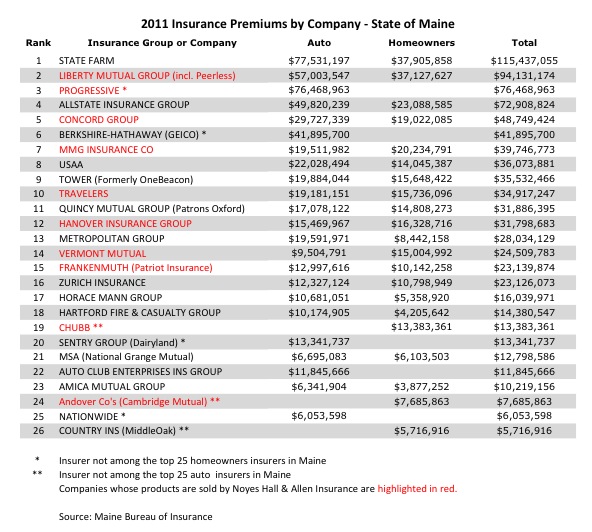

Most people justifiably think medical insurance is the type most affected by marriage. That’s where most of the public discussion is, too. But Maine homeowners and auto insurance contracts also treat spouses very differently than other people.

How does being married affect your Maine home and auto insurance? Let’s look at the most common insurance forms in Maine, ISO homeowners and auto policies. Although they are industry standards, your policy form may be different. Check with your own agent to be sure.

What Happens to Your Homeowners Insurance When you Get Married?

Spouses who reside in the same household are automatically defined as “YOU”. In insurance, it’s good to be YOU.

On most policies, an INSURED is defined as:

- YOU;

- your resident relatives;

- full time students who are < 24 and your relatives, and lived with you prior to moving out; and

- certain other minors in your care.

Are unmarried couples INSUREDS or not? To answer that, we have to ask the grammatically incorrect question, “who is YOU?”

“YOU” is defined as:

- The Named Insured, as shown on the front page of the policy (called the Declarations);

- That person’s spouse if they are a resident of the same household.

What if you were married instead?

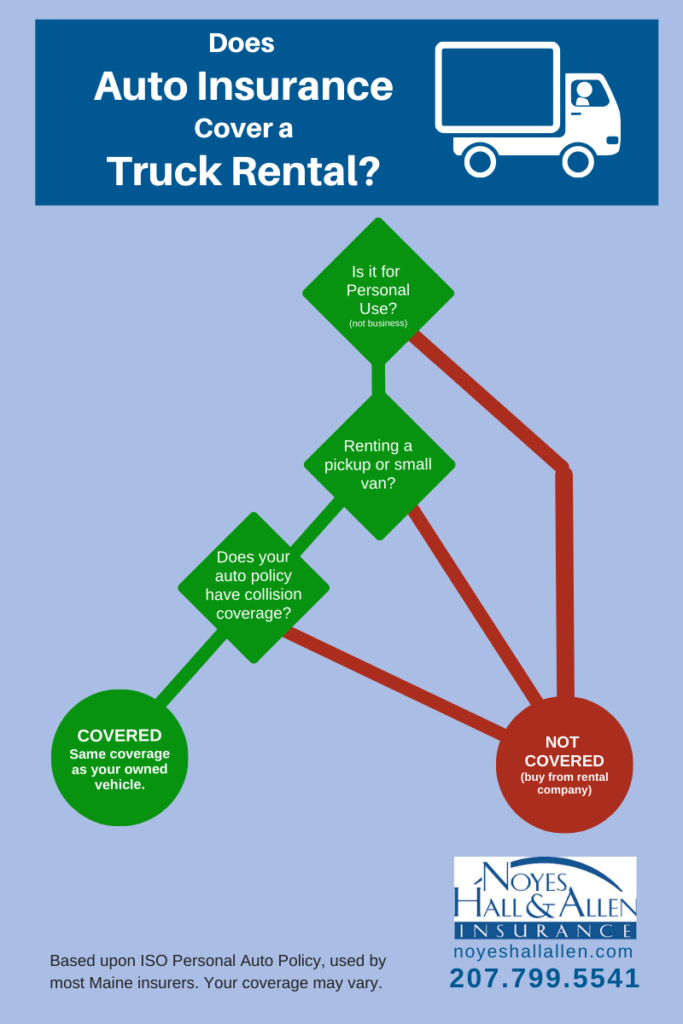

How Marriage Affects Auto Insurance

The definition of YOU in the auto policy is quite similar. It includes the Named Insured and a spouse who is a resident of the household. One additional benefit of being married: your interest in the policy transfers to a surviving resident spouse upon your death.

Warning!

You probably noticed that a spouse must be a resident of the same household to have all of these benefits. If you separate, your status changes. Divorce affects your homeowners and auto insurance, too.

It’s important that you contact your Maine insurance agent to talk about these situations. They can help you make sure that you remain insured, one way or another.

If you live in Southern Maine and are looking for an Portland Maine area independent insurance agency that can answer these and other insurance questions, call Noyes Hall & Allen at 207-799.-5541.