Are you looking for a commercial lease for your Maine business? Moving your business from home or a co-working space to your first real office? Expanding your retail footprint from Portland to Westbrook or Scarborough? Just looking for new space? Either way, negotiating and signing a lease is a big move. It’s also a big commitment. And a legal contract.

A new location is an exciting opportunity for your Maine business. It’s tempting to lock in a great location by quickly signing a lease. Be a smart business person. Review it with your attorney, accountant and insurance agent first. It can save you trouble during the term of your business lease.

Why a Written Lease is Important

It’s good to have a written lease. It’s a legal contract that you can refer to whenever you have questions about your space. It’s also in black-and-white, which reduces misunderstanding when conflicts arise. And, a written lease is easy to review with your trusted advisors.

Review Your Lease with Your Advisors – Before You Sign It

If you have an attorney, make sure they review your lease. They know what clauses are standard, and which are unusual in the Southern Maine market. They can help you negotiate with your potential landlord. Likewise, your accountant can determine tax implications of your lease. They can set you up to properly record your lease expenditures.

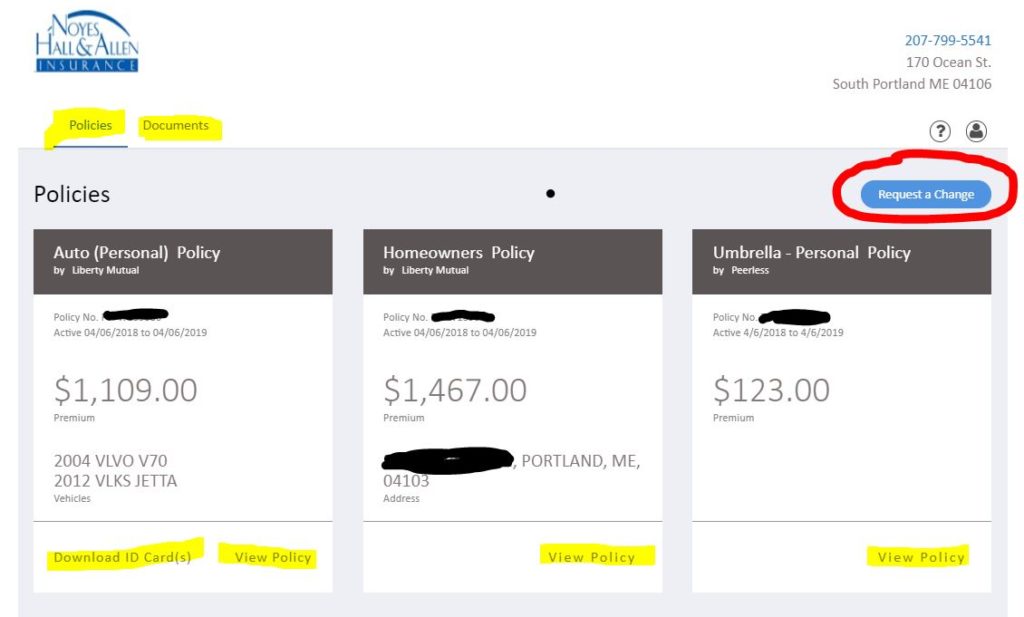

Don’t forget to review your lease with your Maine business insurance agent. Your lease requires property and liability business insurance. Your agent can help make sure you meet your lease obligations. They can also keep your property and other assets protected. Finally, they can help you build an insurance budget for your new location.

Insurance Implications of Your Commercial Lease

Depending on your operations and your lease agreement, you may need to update your business insurance. Here are a few examples.

BUSINESS PROPERTY INSURANCE AND YOUR LEASE

Insuring building items and improvements.

Your new space may need a build-out. Who pays for that? Who insures it after it’s done? And who owns it, and when? A well-written lease addresses those issues.

A good Maine business insurance agent can help you determine whether you need to insure improvements. If you do, they can also tell you how much it will cost. Triple net leases require a tenant to assume many expenses of the building, including insurance. Your agent can help you budget for that.

Insuring Your Contents and Inventory

Your new place may be larger, or be an additional location for your business. If so, increase your insurance to make sure that your assets are properly protected. Don’t forget to insurer new signage, awnings, etc.

In Case of Emergency

What does your lease say about damage to the property? What if the property is damaged to the point where you can’t operate your business for some time? A well-crafted lease outlines the extent of damage and the time limit that triggers the clause.

It’s one thing for your lease to allow you to move somewhere else in case of damage to the property. It’s another thing to be able to afford to move, and to let your customers know about it. An astute Maine business insurance agent can help you buy insurance to pay for business interruption and extra expenses.

BUSINESS LIABILITY INSURANCE AND YOUR LEASE

Your lease may require a certain amount of business liability insurance protection. That may be more insurance than you currently have. You might even need business umbrella insurance to satisfy the lease requirements. Your commercial insurance agent can provide figures to build into your pro-forma for the new location.

Who’s Responsible for What?

Your lease should outline what areas you are responsible for vs. the landlord. It may address issues such as maintenance and snow removal. Make sure that you know what your lease commits you to. Share that with your business insurance agent.

Hold Harmless Clause / Mutual Waiver of Subrogation

Many commercial leases have a “hold harmless” clause. This prevents a landlord from suing a tenant or vice versa, except in cases of extreme negligence. These clauses help to maintain good relations between the parties. Instead of pointing fingers at each other, the landlord and tenant simply pay for damage to the property they’re responsible for in the lease. Many leases also have a “mutual waiver of subrogation.” This prevents the landlord and tenants’ insurance companies from collecting from an other at-fault party after they pay a claim. It’s important to share your lease with your insurance agent so they can make sure your insurance is properly set up.

Additional Insureds and Certificates of Insurance

Many leases require tenants to make the landlord an Additional Insured under their policy. Insurance companies are generally willing to do this when required in a lease. Some insurance companies charge extra for Additional Insureds. Check with your business insurance agent to build your budget.

Does your new location have an exterior sign or outdoor seating area? The city or town may require a certificate of liability insurance showing them as an Additional Insured. Hanging signs and outdoor seating are popular in areas like the Old Port and downtown Westbrook, Biddeford and Saco. The city wants to make sure that if your sign injures someone, your insurance will pay. Overhead signs are also common in suburban strip retail areas, such as Scarborough, South Portland and Falmouth.

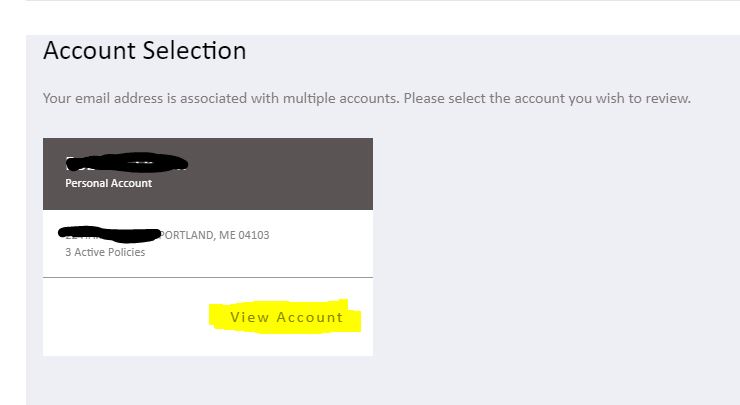

Are you looking for a commercial lease for your southern Maine business?

Call Noyes Hall & Allen Insurance in South Portland at 207-799-5541. We offer a choice of many of Maine’s best business insurance companies. We can help make sure your insurance meets your lease requirements. We can also help you build your insurance budget for this location. We’re independent and committed to you.