(Note: this post updated 2/28/17 to include information about sewer line coverage)

One of our Twitter followers recently asked us: “Do I need exterior sewer/septic line coverage per mailer from my water district?” Great question! Portland Water District offers a service plan through HomeServe, a national home contractor. Exterior water line coverage is $6.00 a month. Sewer line coverage is $8.00. If you buy both, it costs $168.00 per year. We think the water district’s interior plumbing coverage is a bad deal (for $120 a year).

“Off the shelf” homeowners policies don’t cover damage to exterior water and sewer lines. A few insurance companies are starting to offer it – at a fraction of the water district’s price. You might want to purchase this extra protection, depending upon your circumstance and risk tolerance.

(This post only relates to personal properties. Contact a Maine insurance agency for advice about business property insurance.)

3 Questions to Ask Yourself

1) What Repairs am I Repsonsible For vs. the Water District?

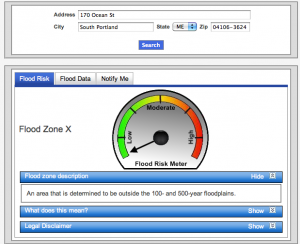

In the Portland Maine Water District, you are responsible for repairing damage to the water service line and sewer line on your property; the utility is responsible for water supply lines that lead to your property. Finding and repairing an underground pipe leak can be expensive.

2) What Pipe Damage Does My Homeowners Insurance Cover?

Water damage from burst or leaky interior plumbing is covered by most homeowners policies; repairs to the pipes themselves are not. Most homeowners policies do not cover water or sewer backup into a basement unless you buy special coverage. Water backup insurance is widely available in Maine.

Most Maine Homeowners insurance policies do not cover damage to water or sewer pipes beyond your foundation walls. Common causes of such damage are tree roots, wear and tear, and crushing by heavy equipment. For most home owners, this leaves a gap in coverage that the water district plan offers to help fill, for an additional charge

3) What is the Cost vs. Benefit of Filling this Gap?

The Portland Maine Water District plan costs about $168 per year. Compare that the average Portland Maine homeowners insurance premium of $875. That’s an extra 19% cost.

3 Things to Know About the Utility’s Water Service Line Program

These plans vary from district to district. These comments relate only to the plan provided by Portland Maine Water District.

1) It is not insurance. It is a service plan offered by an independent, private provider. The water district markets it to their customers, and provides billing along with water and sewer bills. Although it uses terms like “deductible”, “coverage” and “exclusions”, the plan is not insurance; it promises to arrange for a contractor to repair your pipes, and guarantees their work for 1 year.

2) The plan covers repair or replacement costs up to $3,500 per water line service ($7,000 maximum per year), $5,000 per sewer line.

3) Water district plans exclude more perils than a homeowners policy, such as “acts of God” and “pre-existing conditions”. They also exclude “faulty construction/improper maintenance” and “reduction in performance caused by normal wear and tear”. Homeowners policies don’t cover those, either.

Should I Buy the Water District Plan or Not?

If you have limited funds for emergencies, or want to avoid unexpected out-of-pocket expenses, the plan may be a good choice for you. For $168 a year, you’re avoiding up to a $3,500 expense (water line) or $5,000 repair (sewer). But realize that coverage is limited – it contains exclusions, some of which seem to be open to broad interpretation.

The Bottom Line

The plan protects you from expenses not covered by most homeowners policies, but it does not protect you against all of the bad things that can happen to your underground pipes.

If you live in the Portland Water District service area (Portland, Westbrook, Gorham, Cape Elizabeth, Falmouth, Cumberland, Standish, North Windham, Peaks Island and other Casco Bay Islands), and your agent doesn’t provide this kind of information to you, maybe you’d like to work with a new agent.

For answers to your insurance questions, contact Noyes Hall & Allen Insurance at 207.799.5541.