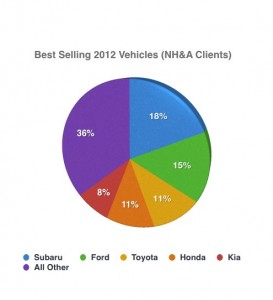

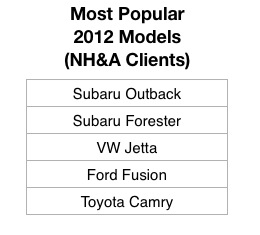

The Portland Maine area economy shows signs of life this spring, including car sales. With roughly half of the model year behind us, we thought it might be fun to share which new vehicles our clients have chosen.

We don’t pretend that this is a scientific survey of which cars are the hottest selling, or that it reflects any trends beyond simply what our Portland Maine insurance agency‘s clients have chosen to buy or lease. However, we suspect it’s a reasonable cross-section of local consumer behavior.

It would be interesting to compare these results against prior years, when $4.00 per gallon gas was a distant threat instead of a reality. We do notice that the best-selling models lean mostly towards the fuel-efficient end of the spectrum.

Car Buyers’ Insurance Tips

If you’re thinking about buying or leasing a new vehicle, here are a few tips for saving money on insurance and making sure you have the proper coverage:

- Check Insurance Prices – Vehicles that seem similar can have very different insurance costs. Call your agent for a quote, or get car insurance quotes from 5 different companies at once from our online quote service.

- Consider Increasing Your Deductible – Generally, new cars cost more to insure than older ones. They’re worth more, and are more expensive to repair. To keep costs down, consider increasing your physical damage deductibles.

- Get the Discounts You Deserve – Insurers offer car insurance discounts for all sorts of things, from air bags to being a non-smoker, anti-theft alarms to having a student on the honor roll. Some even offer special discounts for certain types of vehicles, such as hybrids. Contact your agent and tell them about all of the features of your vehicle.

- Don’t Buy Coverage You Don’t Need – Many vehicles come with a roadside assistance plan. If you purchased AAA or your insurance policy includes roadside assistance, consider whether you want to drop those. This can save you money. Just remember to add it back on when your new vehicle’s roadside assistance benefit stops.

- Combine and Save – If you have your property and auto insurance with different companies, now’s a good time to combine them. Insurers offer substantial insurance discounts when they insure both your property and vehicles.

- Review Coverage on Your Other Vehicles – Maybe you have an older vehicle that’s not worth as much as it once was. When is it time to stop insuring collision and comprehensive coverage? That’s up to each individual’s risk tolerance, but it’s a good time to consider it, anyway.

- Mind the Gap – New vehicles deteriorate rapidly at first. If you made a low down-payment, your loan or lease could be “upside down.” If your vehicle was declared a total loss, the insurance company would pay the “book value”, which may be less than what you owe the finance company. An inexpensive optional coverage called Loan/lease gap would pay the difference. Talk to your agent about this potentially important coverage.