Business insurance inspection is common in Maine. Commercial insurance companies routinely inspect businesses that they protect. Inspections allow them to make sure that they insure businesses that fit their guidelines and that their policyholders are adequately protected.

Is a Business Insurance Inspection Mandatory?

Inspections are expensive for insurance companies. They only perform them when they feel it’s necessary. Often, one of three conditions can cause an underwriter to order an inspection on your business:

- You recently switched insurance to a new company. The new company wants to make sure that your business meets their underwriting requirements.

- You recently had a claim. The insurance company may want to make sure that you have repaired any property damage or addressed the cause of a liability or workers comp claim.

- Your business has expanded or moved. Businesses change, and so do their exposures to loss. Insurance companies inspect periodically to keep up.

- The insurance company hasn’t inspected in several years. Things can change, even if your business stays about the same size and in the same place. The insurance company wants to make sure that your policy stays up to date in case they have to pay a claim.

Can I Opt Out of a Business Insurance Inspection?

Can I Opt Out of a Business Insurance Inspection?

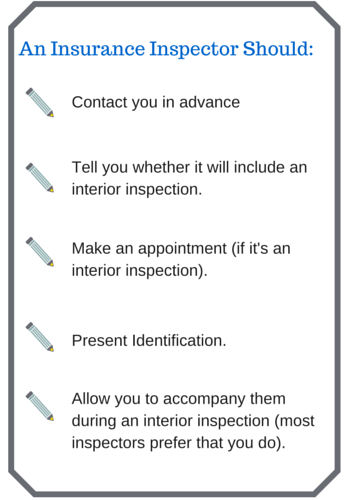

Every insurance policy is a contract. Each policy has an “inspection clause”, which gives the insurance company the right to inspect your business with reasonable advance notice. If you refuse, it’s a violation of the contract. The insurance company can cancel your business insurance as a result.

Does the Insurance Inspector Need to Get Inside my Business?

Almost always. There are two types of insurance inspections: exterior only; and interior/exterior. The company underwriter decides which report to order based upon what they insure, your claim history, and other factors. Unless your property is a rented apartment building, the inspector will probably want to see all the areas.

What Does an Inspector Look For?

Some inspectors are employees of the insurance company, but many are independent contractors. During a routine inspection, the inspector looks for features of your property or operation that can affect insurance claims. Items they typically inspect include:

- Condition of roof, plumbing, electrical, HVAC and similar systems.

- General property condition, paying particular notice to maintenance and general housekeeping.

- Special hazards such as commercial cooking, chemicals, pollutants and machinery.

- Controls and PPE to protect workers.

- Dimensions of structures, so they can estimate the cost to rebuild them.

What Happens During a Business Insurance Inspection?

The inspector sends their report to the insurance company underwriter. If no deficiencies are noted, you will probably not hear from anyone. If the underwriter has concerns, they will ask you to address them. It’s important to pay attention and respond to these. Failing to do so can cause insurance price increases, or even policy cancellation.

If you have a question about Greater Portland Maine business insurance, contact a Noyes Hall & Allen agent in South Portland at 207-799-5541. We offer you a choice of Maine’s preferred property insurance companies. We’re independent and committed to you.