Most insurance companies doing business in Maine would like to forget 2011. Maine narrowly escaped many of the disasters that plagued other Northeastern states (one Maine insurance executive tells of nervously, repeatedly “refreshing” the online map of Hurricane Irene’s storm track). Still, virtually every insurer was affected because they do business in those neighboring states.

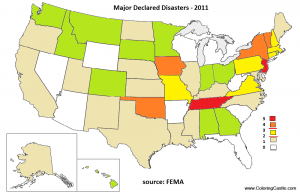

Remember the terrible flooding in Vermont? Hurricane Irene in southern New England? The tornadoes in Central Massachusetts? Widespread power outages from falling snow-covered tree limbs? Insurance companies do. They paid all those claims.

Many people don’t know that insurance companies also buy insurance – called reinsurance – to protect themselves from financial disaster. Reinsurance spreads the cost of risk throughout the world, leveling loss experience. Reinsurance works: despite the recession and the heavy losses, insurance companies remain financially solvent and able to pay claims.

Unfortunately, 2011 set a world record for disasters . Losses were $105 billion, the highest number ever. About 1/3 of those losses, and 4 of the top 10 events, were in the US. That means that reinsurance companies are now increasing the rates that insurance companies pay for property reinsurance. Of course, that translates to higher homeowners and business property rates for you and me. So, what can you do?

6 Ways to Help Offset Rising Property Insurance Costs

- Don’t overinsure. Your Maine business property insurance agent or homeowners insurance agent can help you determine the insurable replacement cost of your property, so you can adjust your protection accordingly.

- Compare rates. There are 2 ways to do this: call around yourself; or consult a Trusted Choice independent insurance agent. This kind of insurance agent represents several insurance companies, and can compare prices and coverage for you.

- Get the discounts you deserve. Don’t pay too much by failing to get the business or homeowners insurance discounts you’ve earned. Have you recently replaced your roof, electrical, heat or other system? Installed an alarm or a generator? All of these improvements may qualify for discounts. Talk to your agent, and ask if there are other discounts available.

- Combine and save. Most insurers give a discount when they insure both your property and vehicles. That goes for business or personal insurance. If you own coastal, seasonal or secondary property, some preferred insurance companies will accept you if they insure your primary home, too. This can rescue you from paying higher non-standard rates with another insurance company.

- Choose deductibles wisely. If you’ve owned your property for a long time, you may have more financial ability to repair small losses (it’s not a good idea to file multiple, small claims anyway). If so, ask your agent how much you could save by increasing your property deductible.

- Maintain your property. It should go without saying, but deferred maintenance leads to claims, and claims lead to higher premiums. Replace your roof or heating system before it causes a loss. Clear leaves from your gutters every fall to prevent ice dams. Regular paint and upkeep can prevent trouble later.

Workers Comp Integrated with Payroll

Workers Comp Integrated with Payroll